tinyBuild Research Report

Business overview

tinyBuild is a video game developer and publisher with global operations headquartered in the US. The company listed on the Alternative Investment Market (AIM) of the London Stock Exchange in March 2021 for a price of £1.69 per share, equating to a market capitalisation at the time of £340m. After rising to the lofty heights of £2.93 at its peak, the share price has plummeted to £0.51, meaning the whole company is valued at just £103m.

Moving away from what the stock market is telling us to the business itself, I'll now cover a little of the company's history and its current business model.

They started off developing and self-publishing their own games, then expanded into offering publishing services to third-party developers. After doing this for a number of years, they realised that third-party publishing is not a sustainable business; it is dependent on the success of individual titles, which comes intermittently.

When a title is successful, the developer is often snapped up by a larger entity which will then gain the benefit of subsequent releases around the already proven IP. In addition, should the developer choose to stay with the publisher for future releases, development efforts are limited to the capacity of the original development team.

Learning from this experience, tinyBuild has moved towards a model of acquiring the IP of successful titles, and thus becoming a first and second party publisher. It does this primarily through "acquihires" whereby it purchases the game IP while simultaneously hiring the development team. The deals are usually structured with an equity component so the developers remain invested in the success of the game. We'll explore some examples of such deals later.

Ownership of the IP increases profit margins and allows the company to expand a single game into a multi-game and multi-media franchise. It has successfully done so with Hello Neighbor, which now has multiple games of different genres across a multitude of platforms, as well as graphic novels, and an animated TV series. There are two other games in the company's portfolio for which it intends to pursue the same strategy, namely: Streets of Rogue and Totally Reliable Delivery Service.

Alongside more traditional game releases, the company has recently expanded out into Games as a Service (GaaS) with the acquihire of Bad Pixel - the developers of Deadside, a first-person post-apocalyptic shooter and survival game. This game is still in early access, but has significantly grown its player base since tinyBuild acquired the IP and began deploying its resources towards it. As of March last year - when the company's FY2021 annual report was published - it was their bestselling game on Steam. The company has also developed a game within the Hello Neighbor franchise that fits the GaaS model - Secret Neighbor. An iOS version of this game was released (largely for marketing purposes) which topped the charts with 4m downloads in the first few days.

The multiplayer GaaS model has the potential to create games with extreme longevity and play times that are orders of magnitude greater than linear games. This is an area in which the Board has considerable experience, with the CEO being an ex-pro gamer, and a Non-Executive Director who was previously Co-President of Activision Blizzard - the original GaaS and MMO company.

On the subject of longevity, it's also worth mentioning that many of the company's most successful indie games are still making significant contributions to overall sales, with some appearing in the top10 daily bestsellers even after a decade. This really sets these games apart from AAA games whose sales drop off dramatically after the initial release, and removes a lot of the cyclicality from the business results. To put this into figures for you, the company's back catalogue contributed 83% of revenue in FY2021, which was a record year for the company.

Games usually begin life on PC gaming platforms like Steam or Epic Games, but successful titles will be ported to other platforms in order to reach the widest possible audience. This includes the PlayStation, Xbox, and Nintendo Switch consoles, as well as mobile and VR. More recently, tinyBuild has started signing deals with companies like Microsoft to bundle games into their subscription services (e.g. Xbox game pass).

Many of the strategies mentioned help to de-risk game releases. For example, producing new games in an established franchise greatly increases the chance of success. Equally when developing new IP, starting with a single platform (e.g. Steam) and releasing the game in early access, allows the company to test the waters and receive feedback from gamers while the game is still in development, before committing major capital to its release. Pre-signing deals with platforms has also become a strategy used by management to secure upfront funding and de-risk development. This predominantly applies to new releases in existing franchises.

Something else worth mentioning is that the company has a 49% stake in DevGAMM LLC, an Eastern European focused game development conference founded and run by the CEO's wife (Lerika Mallayeva), who retains 51% ownership. In 2021, the conference had around 1,800 companies attend from nearly 40 different countries.

For accounting purposes DevGAMM is treated as a subsidiary, and so profits owed to the other party are shown in the income statement as non-controlling interests. Lerika was paid a $148k dividend by the subsidiary during H1 2022.

M&A

I outlined the company's M&A strategy earlier, so now let's have a look at some recent examples.

tinyBuild was very busy in 2021, with seven acquisitions for a total upfront payment of $25.5m (cash and shares). These included We're Five (Totally Reliable Delivery Service) and Hungry Couch (Black Skylands) in February, DogHelm (Streets of Rogue) in June, and Animal (Rawmen) in August. All these deals involved the purchase of the game IP and bringing the development teams on board as contractors.

In September of 2021, the company made its most ambitious acquisition to date of Versus Evil, a US based publisher, and its subsidiary Red Cerberus, a gaming services provider (QA). The intent with this acquisition was to expand the company's publishing capacity, and also to vertically integrate Quality Assurance into the company, thus reducing dependence on external providers.

The final acquisition of 2021 was the aforementioned acquihire of Dead Pixel (Deadside), which also took place in September.

Moving to 2022, the company made a further three acquisitions, the first of which was the acquihire of Demagic in April. What sets this transaction apart was that it involved purely the development team and not any IP. In August they made the opposite kind of transaction: acquiring only the IP of several Bossa Studios titles. Also in August, they acquihired Konfa Games (Despot's Game) in a deal that involved both staff and IP.

It will be instructive to look at a transaction in more detail so you have a better understanding of the typical deal structure.

For this example we'll focus on the acquisition of DogHelm (Streets of Rogue) as it fits into the more standard acquihire model. The consideration for the deal includes both upfront and deferred payments over the following three years. The deferred payments are variable depending on stretching operational targets being met, but have a maximum total consideration of $6.5m, split approximately 50:50 between cash and newly issued equity.

As part of the initial consideration, the company issued 166,204 new common shares at a price of 254p per share, and these shares were subject to a 12 month lock-up period.

A very crucial point here, that applies to all the deals signed to date, is that the compensation is based on cash values, and so the number of newly issued shares will vary depending on the share price. Given that the share price is currently 80% lower than the price at which the aforementioned deal was signed, we can expect dilution to be 5x that anticipated. This risk becomes even more substantial with the larger transactions made in the second half of 2021.

I contacted investor relations with my concerns, and they told me that while they were valid, the management have put in place measures to mitigate against unanticipated levels of dilution. We'll have to wait until the annual results for FY2022 have been released before finding out exactly what these measures are, but I suspect they will involve share purchases on the market to offset the dilution.

The Board has approved the creation of an Employee Benefit Trust (EBT) that will purchase shares on the open market for use in share-based compensation. This is funded by a loan from the company of up to $10m, and in a pre-close trading statement released in January 2023, management disclosed that the trust has purchased 154,300 shares.

It's plausible that this EBT will be used to purchase shares to facilitate contingent consideration payments from acquisition deals, particularly in cases where the recipients are contracted employees of the company.

Management stated in their H1 earnings call that they plan to make future acquisitions predominantly with cash while the share price remains at depressed levels, and have secured a $35m credit facility should larger deals require additional funding.

Marketing

tinyBuild takes a grass-roots approach to marketing that has proven highly efficient and effective. The company has cultivated strong relationships with over 10,000 verified influencers, that together have helped achieve over 5 billion content related views on YouTube. These relationships are highly symbiotic, as the games produced by tinyBuild are very suited to driving engagement, allowing influencers to monetise their channels whilst marketing the game on the company's behalf.

The company also has a significant social media presence of its own, with more than 1.5m followers across all social media platforms, giving them direct access to consumers when promoting upcoming titles. This is substantially more than comparable competitors, including: Devolver Digital, Paradox Interactive, 11Bit, and Team17.

Another way in which the company directly connects with consumers is to involve them in alpha and beta testing. The feedback received is used to focus development on the most well received game characteristics and thus ensure that titles reflect consumer trends on launch.

Speaking to the efficiency of the company's marketing approach, they typically spend less than 7% of annual revenue on marketing. This figure is pretty astounding when you consider the reach they have been able to achieve.

Employee retention

tinyBuild want all their employees to feel and operate like entrepreneurs within the company. This is achieved in part by giving them equity stakes, but it also comes as a byproduct of the fact that most employees belong to groups that were originally independent development studios prior to their acquisition, and still operate largely autonomously.

The company has a strong focus on employee welfare, with strict policies against "crunching". In a more extreme example, last year they spent $2m evacuating all 50 of their staff members from Russia and relocating 30 staff members based in Ukraine to the western part of the country, away from the fighting. At one point the CEO was even housing multiple families in his own home, while more permanent accommodation was found for them.

All these actions have cultivated a strong sense of loyalty among employees, that is evidenced by the company having one of the lowest levels of staff turnover in the industry - in the low single digits, compared to an industry average of 15.5%.

Income

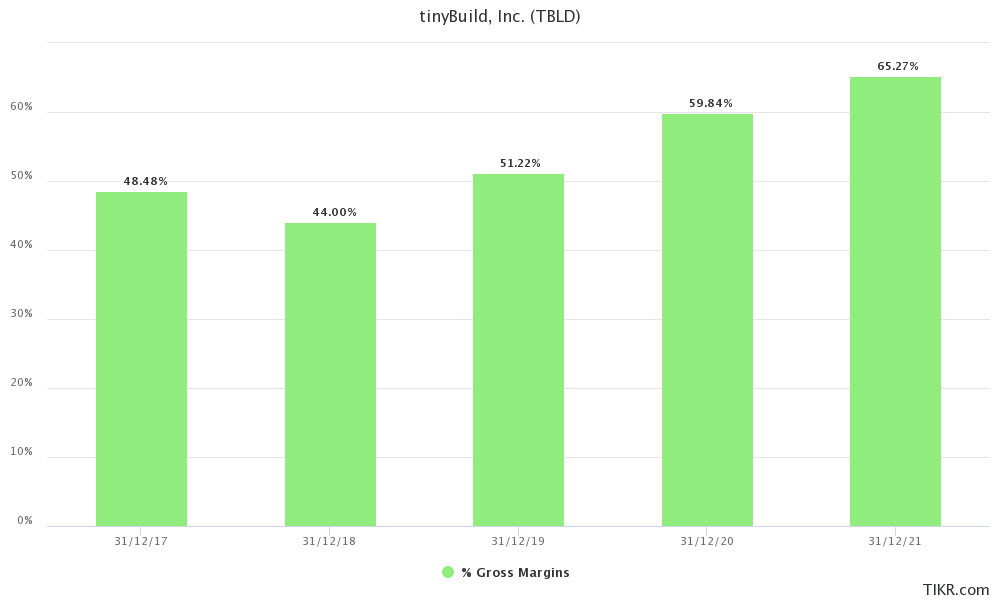

For the year ended 31 Dec 2021, revenue was $52,153k (FY20: $37,648k), a 38.5% increase on the year before. This outstripped the growth in cost of sales (19.8%), leaving gross profit margin improved at 65.3% (FY20: 59.8%).

Operating expenses for the period were $21,509k, comprising general administrative expenses of $14,469k, share-based payment expenses of $2,452k, and IPO related costs of $4,588k. Subtracting these from the gross profit gives an operating profit figure of $12,532k (FY20: $7,664k) and an operating profit margin of 24.0% (FY20: 20.4%).

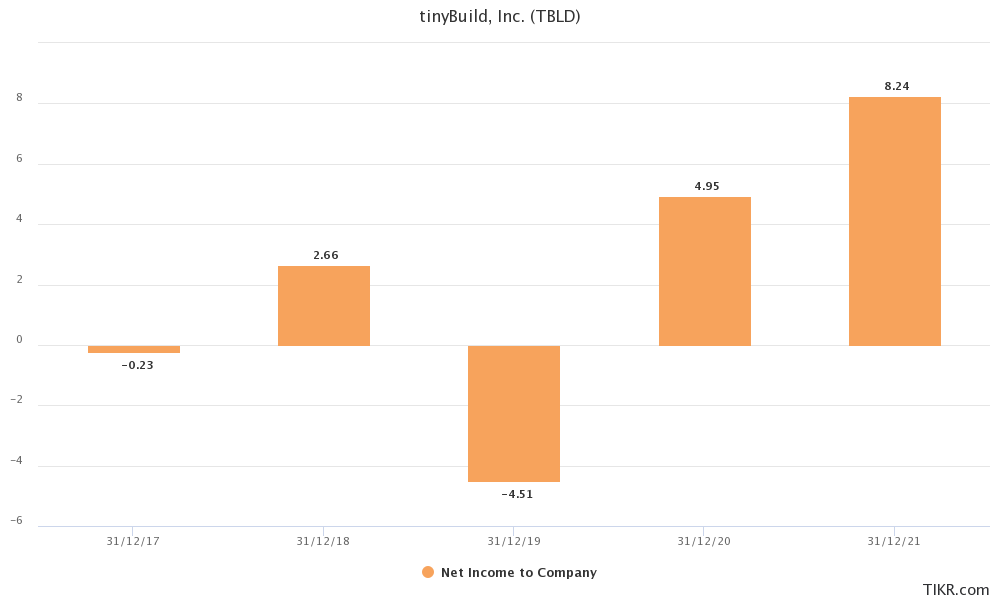

Removing a further $8k for finance costs and $4,281k for income tax we get the net profit of $8,243k (FY20: $4,948k), and net profit margin of 15.8% (FY20: 13.1%). This equates to $0.043 per share using the shares outstanding at the time, or $0.040 per share with the most recent share count.

Additionally, the management provides an adjusted EBITDA figure which removes depreciation and amortisation (except for amortisation of capitalised software development costs), share-based payment costs, acquisition costs, other non-recurring items, IPO related costs, and other operating income ($Nil in 2021) from the operating profit figure. After excluding this rather long list of items we get an adjusted EBITDA figure of $22,239k (FY20: $15,275k).

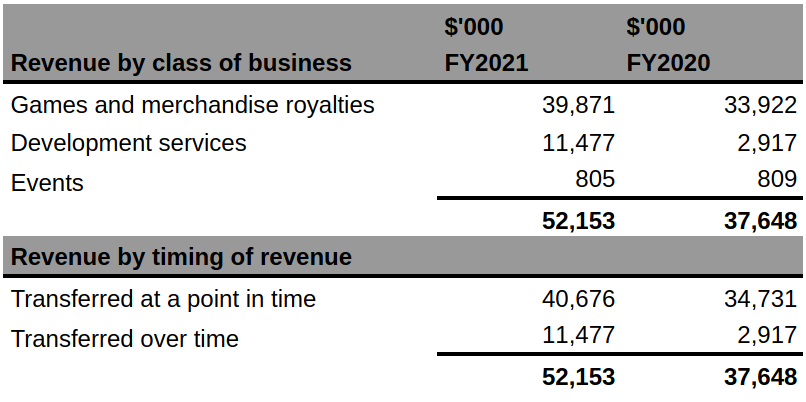

In the notes to the financial statements we are given a breakdown of the Company's revenue by class and timing. We can see that games and merchandise royalties made up the majority of revenues, with smaller contributions from development services and events.

The Company's game and merchandise royalty revenue can be further divided between Own-IP and Third-party IP. In FY2021, Own-IP generated $30,640k (FY20: $24,683k) in revenue and Third-party IP generated $9,231k (FY20: $9,239k). It's interesting to see from these figures that all the growth in royalty revenue for the year came from Own-IP rather than Third-party IP, which is inline with their stated strategy.

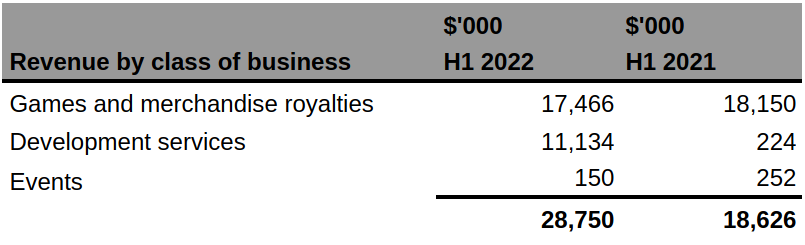

Moving on to H1 2022, revenue came in at $28,750k (H121: $18,626k), with a gross profit margin of 68.5% (H121: 70.7%). The gross profit margin decreased slightly due to the consolidation of lower margin businesses (Versus Evil and Red Cerberus).

Operating profit was $6,805k (H121: $689k), calculated by subtracting $12,000k in general administrative expenses and $887k in share-based payment expenses from the gross profit figure of $19,692k (H121: $13,177k). The substantial increase over the prior year can be explained by the fact that the IPO related costs were front-loaded in the first half 2021.

Net profit for the period was $4,483k (H121: $297k loss), equating to $0.022 per share (H121: $0.001 loss per share). Management's adjusted EBITDA figure was given as $9,882k (H121: $7,905k). This figure accounts for exceptional expenses of $1.0m incurred during the relocation of staff out of Ukraine and Russia due to the conflict.

Revenue contributions from Own-IP increased to 83% (H121: 78%), driven by strong organic performance and recent IP acquisitions (e.g. Deadside).

There was only one game released during H1 2022 and 99% of revenue came from the back catalogue, so we can expect H2 revenue to be boosted by the release of 8 new titles.

Breaking down the revenues by class, we can see that development services made up a much larger share of H1 revenues in 2022 than in 2021. Red Cerberus is likely to have contributed to this along with payments for platform deals signed ahead of game releases in H2 2022.

Games and merchandise royalty revenues can again be divided into Own-IP of $13,107k (H121: $14,100k), and Third-party IP of $4,359k (H122: $4,050k). You'll notice that the contribution from Own-IP as a percentage of royalty revenues decreased from the previous year (75% vs 78%), while the percentage of overall revenues increased (83% vs 78%). This was due to a greater share of Own-IP revenues coming from development services in H1 2022.

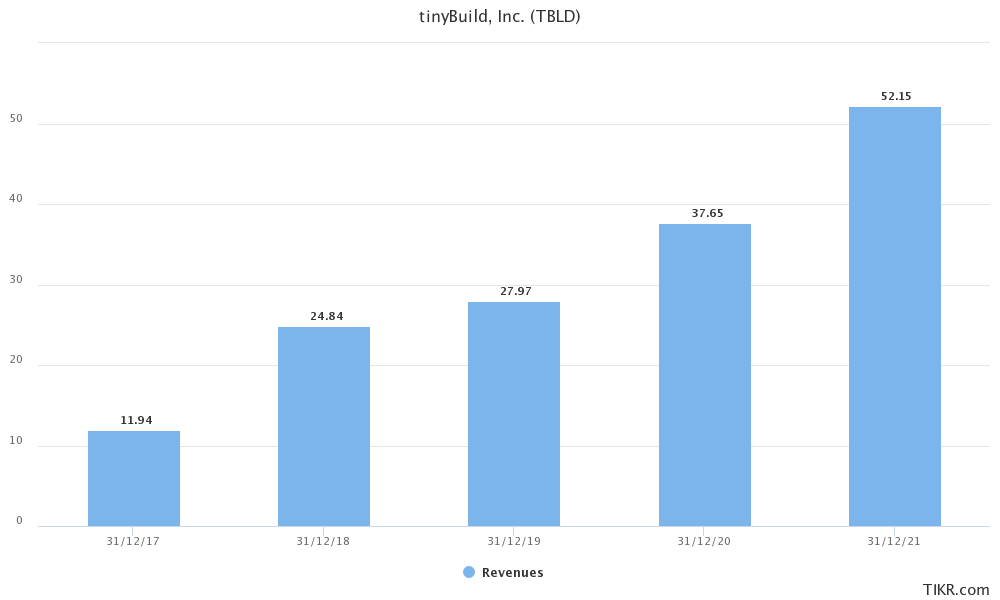

Looking back over the five years of revenue figures the management has provided, which includes a number of years when the company was unlisted, we can see very substantial and sustained growth at a compound annual rate of 44.56%.

Gross margins have shown a similarly positive trend with the move towards 1st and 2nd party publishing.

Net income has been a little more bumpy, with some negative years, but the overall growth has been sizeable, and it looks set to remain more sustainably positive now the company has grown and diversified.

Balance sheet

At 30 Jun 2022, tinyBuild had total assets of $127,226k of which $70,183k were non-current and $57,043k were current. The vast majority of the non-current assets are intangible ($69,019k), split into software development costs ($29,728k), purchased intellectual property ($20,439k), customer relationships ($3,906k), brands ($1,744k), and goodwill ($13,202k). Current assets comprised $14,431k of trade and other receivables and $42,612k of cash and cash equivalents.

All software development costs are capitalised, and so recognised as an asset on the balance sheet which is amortised over time, allowing them to be matched to the subsequent revenues they generate. These costs largely relate to amounts paid to external developers, consultancy costs, and the direct payroll costs of the internal development teams. External software development costs are amortised over the life of the game (which varies with the game's success), but internal software development costs are amortised over a fixed period (usually 1-2 years). In both cases, amortisation begins once the game is released.

Looking at the other intangible assets, brands are amortised on a straight-line basis over 15 years, and both customer relationships and intellectual property are amortised on a straight-line basis over 7 years.

On the other side of the ledger were total liabilities of $23,961k, with $9,253k of this non-current and $14,708k current. The non-current components were contingent consideration of $6,336k, deferred tax liabilities of $2,716k, and lease liabilities of $201k. Contingent consideration relates to the expected value in shares that will be issued to satisfy deferred payments for acquisitions. Current liabilities included trade and other payables of $9,645k, contingent consideration of $4,793k, and lease liabilities of $270k.

The current liabilities are well covered by current assets, with a current ratio of 3.88, or 5.75 if you exclude the contingent consideration.

Subtracting the total liabilities from the total assets gives us the total equity of $103,265k, $103,250k of which is attributable to shareholders.

Using the average equity figure for FY 2021 of $67,601k and the operating profit for the same year ($12,532k), we can calculate the return on equity (ROE) as 18.5%. This figure is being somewhat depressed by the substantial amount of cash on the balance sheet. I expect ROE to be significantly higher once this cash is deployed into productive assets.

It's also worth mentioning that while the company doesn't currently have any debt on their balance sheet, it does have a $35m credit facility setup with Bank of America, which is intended as a source of cash should it be required for future acquisitions. As of the most recent filings, this facility was undrawn.

Cash flows

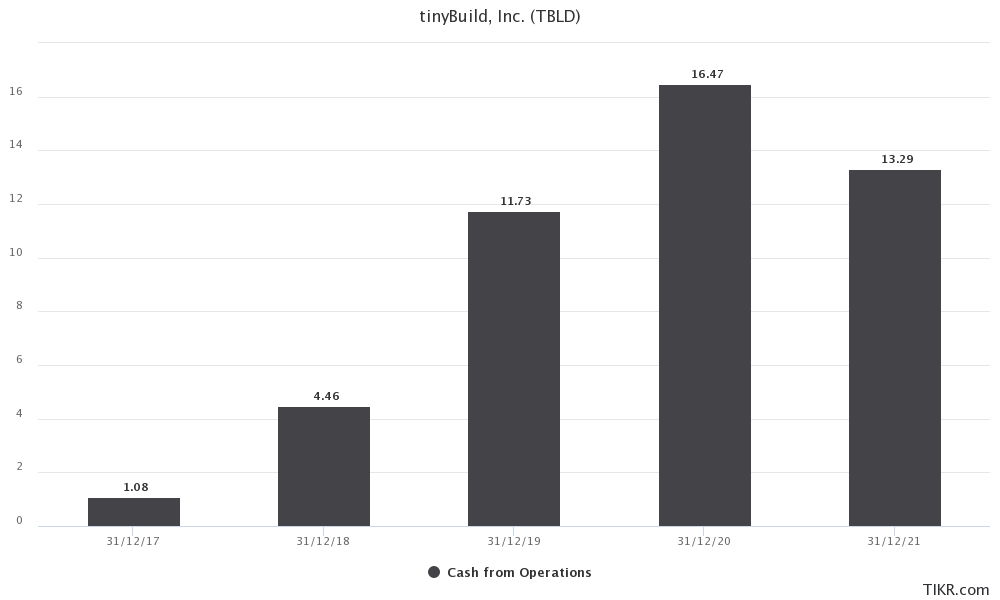

For the year ended 31 Dec 2021, cash flows from operations were $13,290k (FY20: $16,470k). The decrease from the previous year was due predominantly to the increase in receivables exceeding the increase in payables in 2021.

The princely sum of $37,656k was invested during the year (FY20: $7,143k), split between $11,784k for the acquisition of subsidiaries (net of cash acquired), $15,085k for software development, and $10,832k for the purchase of intellectual property.

This investment was in part funded by the proceeds of share issuances during the year, which amounted to $46,839k - net of transaction costs.

The overall net increase in cash during the year came to $22,519k (FY20: $9,304k).

It's important to note that the company was highly cash generative before the IPO and would have been able to sustainably grow even without going public. The funds raised have simply accelerated growth.

In H1 2022, cash generated from operations was $8,811k (H121: $570k used in operations). A total of $14,245k was invested in software development, and $554k in property, plant and equipment. There wasn't much in the way of financing activities beyond a payment of $148k in dividends to a non-controlling interest (related to DevGAMM LLC). The net movement of cash during the period was a decrease of $6,220k.

Looking back over the operating cash flows for the last five years, we can see substantial growth.

Management

The Company's Chief Executive Officer and Founder is Alex Nichiporchik. Prior to founding tinyBuild, Alex was a pro-gamer and games journalist. He has since produced over 20 games and led the way in building the company's marketing, including forming relationships with key influencers.

From the earnings calls, Alex comes across as highly competent with a very clear vision and strategy for the company. He also holds a very substantial stake amounting to 37.8% of the shares outstanding, making him well aligned with other shareholders.

Luke Burtis is also a Founder and serves as the Company's Chief Operating Officer. He has established long-term partnerships with over 50 developers as well as multiple global distribution platforms, and built the team from 3 employees in 2013 to 127 across the globe at YE 2021. Luke and others close to him hold a stake in the company equating to 7.0% of the shares outstanding.

Tony Assenza is the Company's Chief Financial Officer. He has completed 6 acquisitions, managed multiple investments into tinyBuild and built the financial infrastructure to deal with the company's growth. I believe tinyBuild is his first major role, but he too comes across well in the earnings calls, with an obvious understanding of the economics of the business.

The Company's Chairman is Henrique Olifiers - CEO and Co-Founder of London based game developer and publisher, Bossa Studios. Henrique has 23 years' games industry experience, including working at Jagex and Playfish.

The Company has two Non-Executive Directors, the first of which is Neil Catto - CFO of AIM-listed Boohoo Group Plc. Neil is also a qualified Chartered Accountant.

The second Non-Executive Director is Nick van Dyk - Co-President of Activision Blizzard Studios from 2015-2019, and before that Senior VP at The Walt Disney Company. He has more than 20 years experience in the entertainment industry. The guy is a heavy hitter and brings valuable knowledge about developing Games as a Service products and franchises.

Executive compensation includes a base salary, cash based bonus, and stock options.

For FY2021, the base salaries were $350,000, $308,000, and $220,000 for the CEO, COO, and CFO, respectively. All three received the same annual bonus of $420,000.

Alex Nichiporchik and Luke Burtis both retained significant equity stakes in the company on IPO and so were not issued any stock options in the year. Tony Assenza was granted 125,931 options with an exercise price of $1.59 per share. These are now underwater and will expire on 1 February 2031 unless exercised.

I expect the Employee Benefit Trust will be offsetting any future shareholder dilution from equity-based executive compensation by purchasing an equivalent number of shares on the market.

Annual bonus awards (and I expect future stock options also) are dependent in equal measure on revenue and adjusted EBITDA. The targets are not specified for FY2021. I'd prefer this to be EPS, which defends against excessive use of stock in acquisitions, but we'll have to rely on management's substantial equity stakes to dis-incentivise earnings dilution.

The other directors are paid an annual fee, which was $120,000 for Henrique Olifiers, $70,000 for Neil Catto, and $100,000 for Nick van Dyk. Henrique's fee for 2021 was satisfied with the allotment of 51,454 shares at the placing price.

Other major shareholders were Swedbank Robur AB with 8.2%, NetEase with 6.3%, and Franklin Templeton Investments with 5.0%.

Valuation

It doesn't take much torturing of the numbers to see this company is incredibly cheap. On some simple valuation metrics like trailing P/E, P/OCF, and even P/B, the company is very modestly priced when compared to the strength of its business model and long runway for growth.

Using a market capitalisation of $125.56m or share price of $0.62, its trailing P/E, P/OCF, and P/B are 9.7, 5.5, and 1.2, respectively. With these numbers you're literally paying for zero growth.

When you realise that these multiples are being applied to a company that has grown revenue and cash flows from operations over the last 5 years at compound rates of 44.56% and 87.29%, respectively, you can see there's a yawning chasm between price and value.