Firm Returns Weekly - TMI, WBD, TBLD

Factors impacting the dry bulk charter market; Paramount merger talk; and Verses Evil shut down.

Taylor Maritime Investments

Trade disruption

As I've discussed before, charter rates have climbed since mid-November and now seem to be rolling over as we head into the seasonally weak period around the Christmas and New Year holidays.

I thought it might be interesting to look into some of the factors that have driven this rise in rates, and how likely they are to persist.

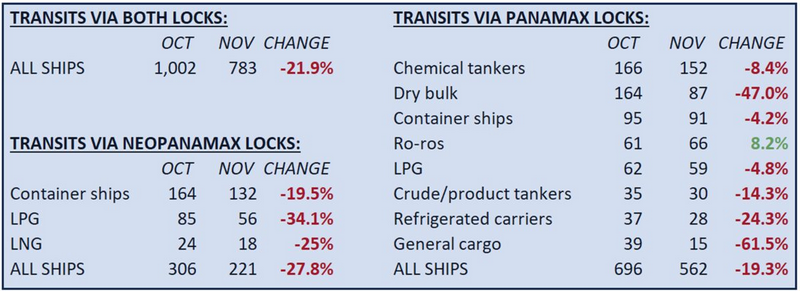

The strongest influence has come from the drought currently impacting transits through the Panama Canal. As you can see below, transits of dry bulk vessels through the Panamax locks fell 47% from October to November.

https://www.freightwaves.com/news/panama-canal-transits-plunge-as-larger-ships-are-turned-away

These vessels are travelling through the Suez Canal instead, adding around 10 days to the journey, and effectively decreasing supply. This is offset somewhat by lower exports of US grains due to the same droughts, putting a cap on the upside for charter rates.

https://www.freightwaves.com/news/panama-canal-crisis-forces-us-farm-exports-to-detour-through-suez

There is however another factor emerging: attacks on vessels in the Red Sea, causing traffic to reroute around the Cape of Good Hope.

Only around 5% of dry bulk traffic usually goes through the Suez Canal, so the impact on dry bulk charters wouldn't normally be so significant. But the rerouting of vessels from Panama has changed the equation. Depending on how long the threat exists, this could add meaningful support to charter rates and counterbalance any softness in demand.

https://www.freightwaves.com/news/red-sea-chaos-could-boost-tanker-and-container-shipping-rates

Warner Bros. Discovery

Paramount merger talk

We heard the week that WBD CEO David Zaslav met with Paramount CEO Bob Bakish for what has been rumoured to be early merger talks.

We'll have to see how things play out, but there are pluses and minuses to such a deal. On the plus side, it would add another 60+ million streaming subscribers to WBD (though there could well be some overlap). It would also further expand WBD's content library with IP such as Star Trek and Mission Impossible, and result in the creation of the largest movie studio on the planet (the other big players are Disney, Universal, and Sony).

The negatives are that Paramount is in substantially worse financial shape than WBD, and they'd have to rapidly turn it around before it sank the combined ship. They've demonstrated that they can with Warner Media, so it's not out of the realms of possibility.

tinyBuild

Equity raise

I gave my views on the equity raise in a separate newsletter, so give that a look if you want the details.

https://www.firmreturns.com/tinybuild-equity-raise/

Versus Evil shut down

After writing the above article, I found out the news that Versus Evil has been shut down, but the games in their pipeline - most notably Broken Roads - will still be published.

Not a happy result, but a necessary one that significantly de-risks the company and removes a drain on its resources.

https://gamertweak.com/versus-evil-shuts-down-lays-off-staff/