Firm Returns Weekly - ECOR, TMI, TBLD

Ecora Resources

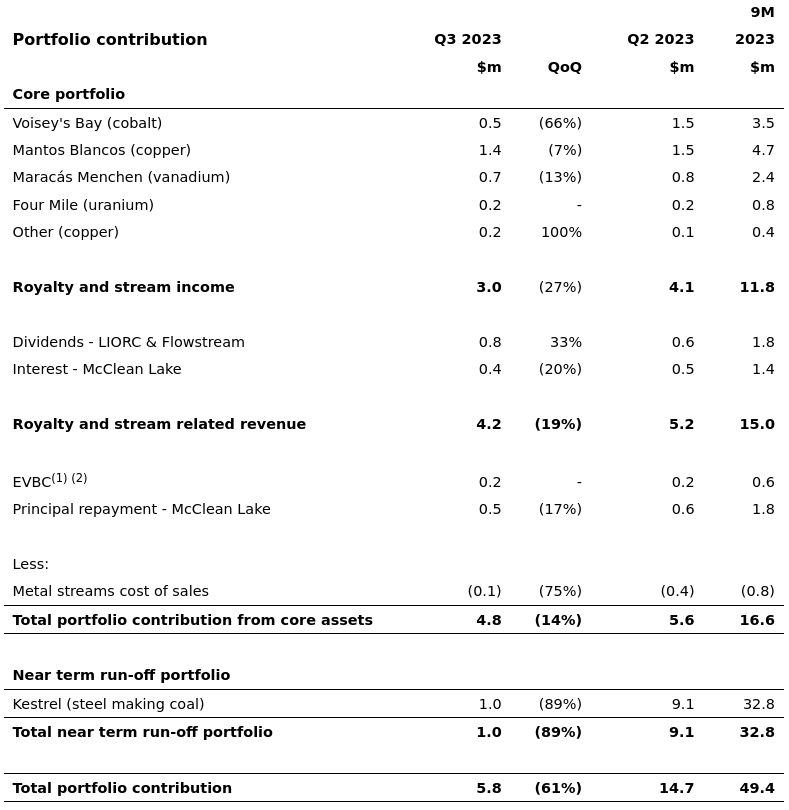

Ecora Resources released their Q3 trading update this week. Portfolio contribution was down significantly at $5.8m vs $14.7m in Q2, due primarily to low production volumes at Kestrel and Voisey's Bay.

The lower volumes at Kestrel were the result of operations moving outside Ecora's royalty area, as previously guided, and it is expected that operations will move back inside Ecora's royalty area towards the end of Q4, with materially higher volumes in H1 2024.

Production at Voisey's Bay was limited to a single delivery due to a maintenance period at the Long Harbour refinery. There are a further three deliveries scheduled for Q4 2023, and a significant ramp up in production volumes is expected in 2024, as the underground mining operations are brought online.

You can see the full portfolio contribution break-down below.

https://www.londonstockexchange.com/news-article/ECOR/q3-2023-trading-update/16180598

Taylor Maritime Investments

We also had a trading update from TMI. Net Asset Value (NAV) per share on 30 Sep had fallen to $1.31 vs $1.56 on 30 June, largely due to the low charter rates seen during the quarter. Since the quarter end, asset values have recovered back to their June levels in line with the recovery in charter rates.

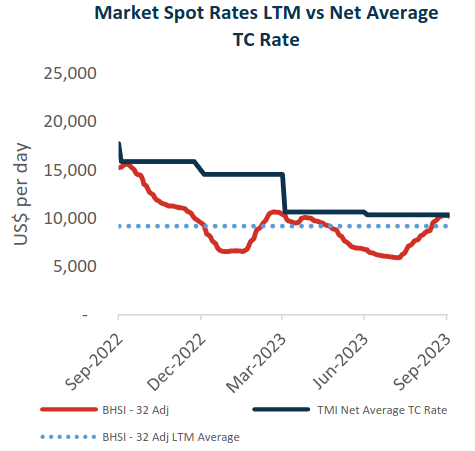

You can see from the chart below that TMI's chartering strategy has kept rates above market levels for much of the last year, but they're now converging with the index as longer term contracts come to an end, and they've avoided signing new ones at lower rates. Management is anticipating stronger rates in Q4, which the fleet is positioned to capture.

The blended time charter rate for the combined TMI and Grindrod fleet was c.$10,700 per day at quarter end, and has since risen to c.$10,900 per day. This is below the equivalent blended break-even of $11,850, including debt interest costs, so they still need to see some improvement in charter rates for the fleet to be positively cash flowing again. They're also working to reduce the break-even value through operational efficiencies afforded by the business combination. No specific target level has been given, but management has said anything up to a $1,000 reduction could be possible.

In the meantime, they've made good progress in paying down their debt, with $42m being repaid during the quarter. TMI's debt balance at quarter end stood at $167.6m, equating to a debt to gross asset ratio of 26.9%, while Grindrod's debt balance (including lease liabilities) stood at $168.9m.

The combined owned fleet comprised 42 vessels at quarter end (TMI: 21 and Grindrod: 21). Strategic selling of the older vessels has brought the average fleet age down to 10.5 years (vs 13.0 years pre-acquisition), and raised the average carrying capacity to c.40k dwt (vs c.33k dwt pre-acquisition).

Management is intending to complete further vessel sales at a reasonable cadence through 2024, and is prepared to reduce the fleet down to 30 vessels if necessary. However, they see a more favourable outlook for rates in 2024 vs 2023, so don't want to unnecessarily shed tonnage that could otherwise have captured higher charter rates.

tinyBuild

Stray Souls

Stray Souls was released on PC, Xbox, and PlayStation by Versus Evil on Wednesday (25 Oct). Things were looking reasonably promising prior to the release, with the game being #358 in the wishlist rankings, and releasing at the relatively high price point of $29.99 (20% launch-discount was applied on Steam).

Indeed, at launch the game attracted quite a bit of attention: with an appearance at the top of the New & Trending list on the Steam homepage, a good volume of viewers watching the release livestream, and early sales taking it into the top-250 selling games.

Steam store screenshots for Stray Souls on 25 Oct.

However, this is where the good news ends. The game received an absolutely brutal reception from players (not the kind of brutality the developers were aiming for), with only 27.12% of the reviews as of 28 Oct being positive.

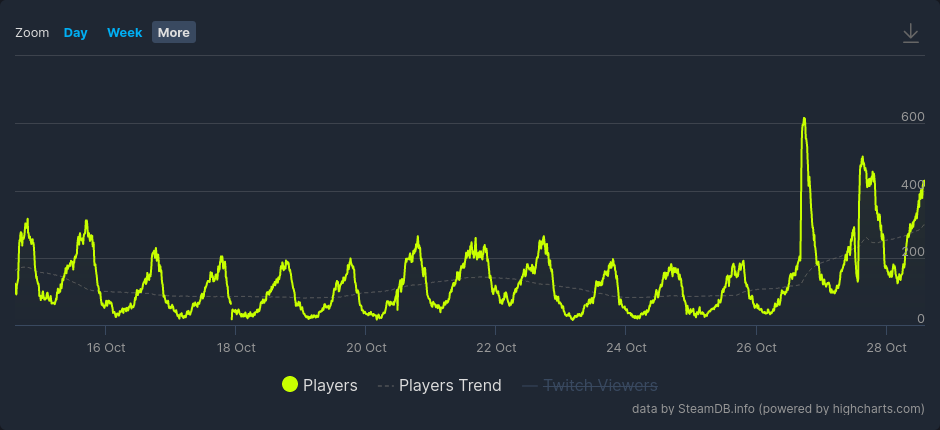

Looking at the concurrent player numbers, the game achieved a peak of 170 on the day of release, and today the 24-hour peak is just 43.

We don't know how it's done on consoles, but I wouldn't expect much given the incredibly low review score on Steam.

The failure of this title means we could be looking at just one major release from Versus Evil this year - assuming Broken Roads is a success. Something has got to change here as I can't imagine a single third-party release, currently #137 in the Steam wishlist rankings, can cover the expense of a 50-strong publishing team.

Hello Neighbor

In more positive news, the Halloween update for Secret Neighbor has now been released and generated a significant boost in engagement - shown in the concurrent player numbers.

More broadly, the whole Hello Neighbor franchise has been included in Halloween sales across PC, Xbox and PlayStation, with discounts as large as 80% for older titles.

The season finale of the animated series will also be releasing today (28 Oct), and we can expect the Hello Neighbor 2 update, for which there has been much anticipation, to drop in the coming days. Hopefully we'll have some positive news to discuss on this front next week (as well as Slime 3K which releases on 2 Nov).

YouTube

Finally, I just wanted to give you a reminder that I record videos discussing the newsletters and upload them to YouTube each week. If you just want the audio, you can also find them in podcast players like Spotify, Google Podcasts, and Amazon Music.

Here's the video from last week: