Ecora Resources Research Report

Business Overview

Ecora Resources (ECOR) is a royalty and streaming company based in London, and listed on the London Stock Exchange (LSE) with a market capitalisation of ~£300m - at a share price of £1.15. It also has secondary listings on the Toronto Stock Exchange (TSX) in Canada and the OTC market in the US.

Prior to 5 Oct 2022, the company was called Anglo Pacific Group (APF) and changed its name to Ecora Resources to reflect a pivot away from coal, which has historically been its largest source of revenue, to future facing commodities such as Cobalt, Nickel, and Copper.

In 2020, the company had two major coal royalties: Kestrel - metallurgical coal - and Narrabri - thermal coal. Management made the decision in 2021 to sell the Narrabri royalty back to its operator - Whitehaven Coal - for a fixed consideration of $21.6m, paid in instalments from 31 Dec 2021 to 31 Dec 2026, and a variable contingent consideration component estimated at $14m, dependant on future coal prices, production volumes, and mine expansion. In hindsight, this wasn't the best timed of transactions, as not only did they recognise a significant loss against the $45m carrying value of the asset, they also missed the subsequent boom in thermal coal prices.

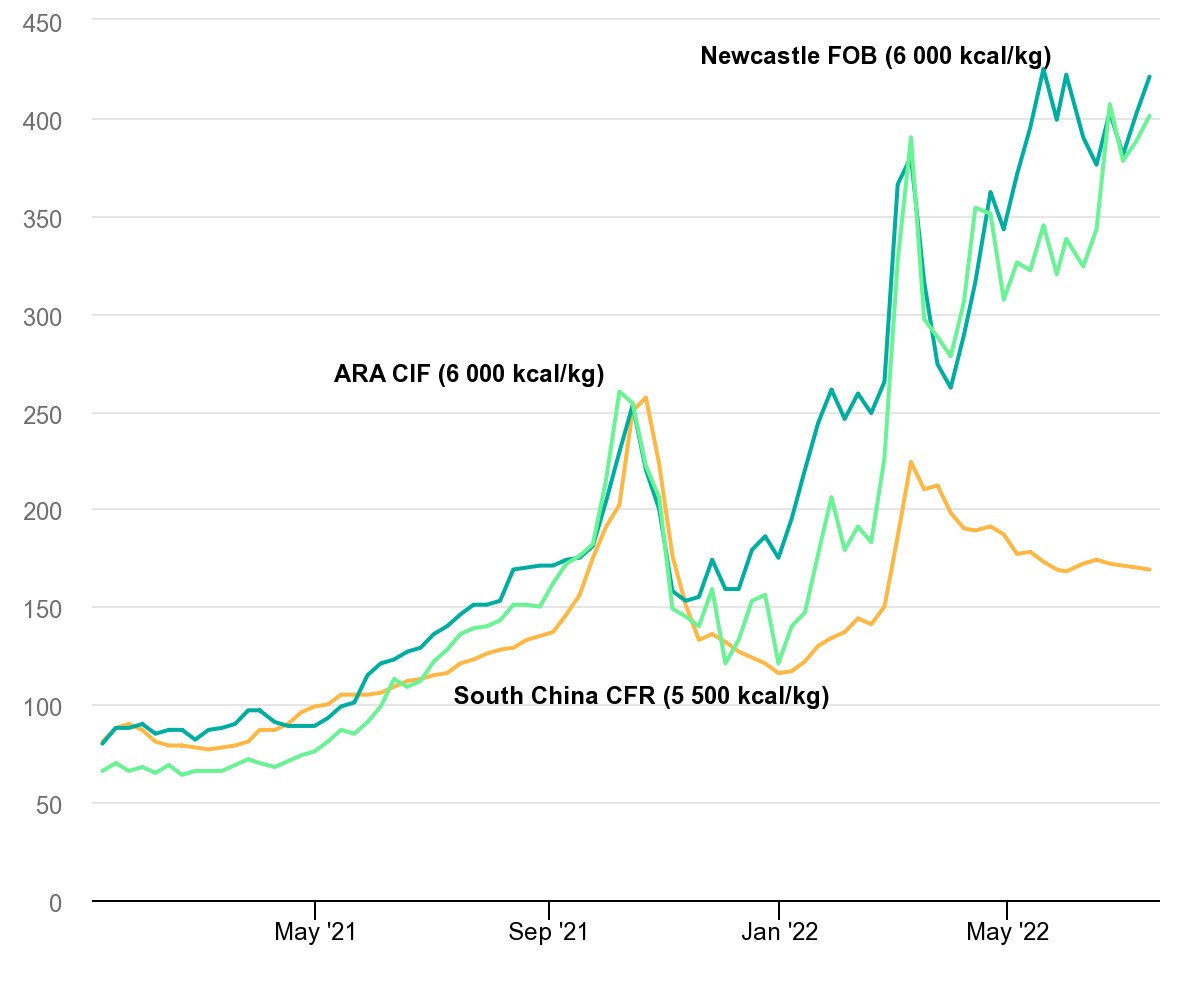

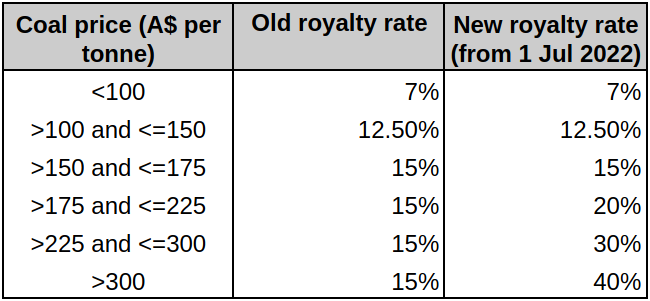

Thankfully, they captured the upside in the metallurgical coal price via their Kestrel royalty. Their windfall included an added bonus derived from the unusual nature of the royalty held - the company owns a freehold over an area of the mine that includes the sub-stratum land. This is rare because the land below the surface is usually retained by the state when a freehold is sold. The result was that when the Queensland Government changed the royalty rate to capture more of the record profits being generated by the miners, Ecora also quietly benefited.

With metallurgical coal prices well in excess of A$300/t in H2 2022, the company captured very substantial upside. To be exact, Kestrel produced a combined US$155m across FY21 and FY22, compared to an expected US$32m had coal prices stayed at the US$130/t level seen in the first quarter of FY21.

As alluded to earlier, the company has pivoted to focus on commodities essential to a sustainable energy transition. The centrepiece of this new strategy has been two transformational acquisitions, which completed on 12 Mar 2021 and 19 Jul 2022, respectively. Both were financed with a combination of cash, debt and equity, with the exceptional cash flows from Kestrel contributing substantially to the second acquisition.

We'll look at the details of these acquisitions a little later on, but I think it would be beneficial at this point to define how a natural resources royalty or stream works.

A royalty is a form of financing, whereby the royalty company provides the mine operator with an upfront payment in return for a percentage of the revenue generated from the mine. The royalty is usually restricted to a specific area, and as such, the holder will only have an interest in the operations that fall within this area. In some cases (e.g. Kestrel), mining operations may move outside the land covered by the royalty and so the payments will end.

There are two main types of royalty owned by Ecora: Net Smelter Return (NSR) and Gross Revenue Royalty (GRR). The former subtracts the costs of transporting and refining the mined resources from the top-line revenue generated from sales, while the latter is based purely on the gross revenue and doesn't deduct any expenses. NSR royalties are more prevalent in cases where the mined products require a significant amount of processing before being saleable.

Much like there is a primary and secondary market for equities, royalties can either be purchased directly from the mining operator (primary), or from the current owner (secondary). Ecora engages in both types of transactions.

A stream is similar to a royalty, but instead of receiving a percentage of revenue, you obtain the right to purchase a percentage of the mine's production at a discounted price. The stream owner is therefore responsible for selling the product and must use a portion of the proceeds to cover the purchase price and selling costs.

Royalty financing offers a number of benefits for mine operators, the first is that it doesn't dilute the ownership of the company - existing shareholders retain full control of the company and its operations. The second is that royalty payments are entirely variable; unlike traditional debt, there are no fixed payments to cover even before the mine is operational. The third is that the royalty sits on one specific asset (much like a mortgage), and so there is no liability on the operator's balance sheet.

There are also specific advantages to owning royalties for investors, namely: inflation protection, diversification, and upside potential. Inflation protection comes from the fact that royalty payments are based on revenue and so insulate you from increases in operating expenses. Diversification is not something specific to royalties - holders of public equities and debt can also diversify - it's more an advantage over mine operators who have their funds concentrated in a single project. Royalty holders also benefit from potential upside in the form of life of mine extensions and above projection commodity prices. This is something you don't get with traditional debt securities.

The market for royalties often becomes buoyant during downturns, when traditional financing options such as debt and equity become unavailable or prohibitively expensive. It's quite likely that we're entering such a economic environment, which should increase the number of opportunities available to Ecora. However, this potential tailwind is counterbalanced by increased competition from precious metal mining and royalty companies being drawn into the non-precious metal market by the expectation of higher demand and prices.

Recent Acquisitions

Voisey's Bay

On 12 Mar 2021, Ecora acquired a holding company with a 70% net interest in a cobalt stream from the Voisey's Bay mine in Canada. The initial cash consideration of the deal was $205.6m, with further contingent consideration subject to cobalt prices and production levels over the first 5 years following closing. The deal was funded using a mix of cash raised from asset sales, debt, and an oversubscribed public share offering.

In FY22, $3.3m was paid in contingent consideration as a result of minimum production and price thresholds being achieved in H2 21 and H1 22.

The mine operator is in the process of transitioning from open pit to underground mining, and as such, there is expected to be a period in which volumes reduce while the open pit is depleted and the underground operations come online. Correspondingly, the contingent consideration recognised on the balance sheet has been reduced to nil, as the minimum production and price thresholds are not expected to be achieved.

The stream entitles Ecora to 22.82% of all cobalt production from both the open pit and underground mining operations, stepping down to 11.41% once 7,600 tonnes of finished cobalt has been delivered. From the deal closing to 31 December 2022, a total of 900 tonnes had been delivered.

Ecora pays 18% of an industry cobalt reference price prevailing on the date of delivery, increasing to 22% once $300m (the upfront amount paid for the stream by its original holder) in net cobalt has been received by the company. To clarify, when the company receives a delivery of cobalt, 82% of its value is credited against the remaining balance. The accumulated credit as of 31 Dec 2022 was $46.0m, meaning a further $254.0m needs to be delivered before the rate increases.

The total deliveries of finished cobalt are expected to be 15.5Mlbs (~7,000 tonnes), which equates to a mine life of ~2035. This is based purely on the current reserves and doesn't account for the potential for further mine life extensions.

The metal stream asset is carried at cost on the balance sheet, and depleted each year on a units-of-production basis. In FY22, the group received 0.59Mlbs (FY21: 0.65Mlbs) of cobalt, resulting in a depletion charge of $6.5m (FY21: $7.3m).

South32 Royalties

On 19 Jul 2022, Ecora acquired a portfolio of royalties over advanced development stage copper and nickel projects from South32 Royalty Investments Pty Ltd (South32) for a fixed consideration of $185m, with a further contingent consideration of up to $15m.

The fixed consideration consisted of a combination of $102.6m cash and $82.4m equity. An initial cash payment of $47.6m was made on completion of the transaction, with the remaining $55m being split into six equal quarterly payments that started in October 2022. The equity component is calculated from the issuance of 43,622,091 ordinary shares at a price of £1.54 per share, and equates to approximately 16.9% of the company.

The contingent consideration is payable subject to future nickel prices and minimum production levels, and as at 31 Dec 2022, was held on the balance sheet as a liability with fair value of $10m.

The two main assets acquired in the transaction were a 2.0% NSR nickel-copper royalty over the West Musgrave project in Australia, and a 2.0% NSR copper-cobalt royalty over the Santo Domingo project in Chile. At the time of acquisition, the West Musgrave mine was owned and operated by OZ Minerals, but has since been sold to BHP. Santo Domingo is owned and operated by Capstone Copper - a leading copper producer operating in the Americas, with several other mines in the region.

West Musgrave is the further developed of the two projects, with first production targeted for H2 2025. The mine's average annual production is expected to be approximately 35kt of nickel and 41kt of copper over the first five years of production, falling to 27kt of nickel and 33kt of copper thereafter, with an expected mine life of over 24 years. Using long-term consensus forecasts for copper and nickel prices, this would equate to between $10m-$15m in annual royalty payments.

Santo Domingo is in an earlier stage of development, with production expected to come online in the second half of this decade. When it does so though, the average annual production of copper is expected to be ~63.5kt and cobalt ~4.7kt. The mine is expected to have an 18-year life, but Ecora's royalty area will only be mined for the first 6-7 years according to current plans, with mining potentially returning in year 14. In the years of production, the royalty is expected to generate between $20m-$35m annually.

Bundled in with these two major royalties was a 1.5% realised value royalty over the Nifty copper project in the North-Eastern Pilbara region of Western Australia. Nifty is a mine restart project owned and operated by Cyprium Metals Limited, with an expected mine life of 6 years. Ecora is only estimated to start receiving royalty payments in the 2nd or 3rd year of production, and the project is still dependent on Cyprium raising the required funding.

One final thing to mention is that there is a AU$10m payment expected from the the West Musgrave mine once production starts, in addition to the royalty payments.

The Rest of the Portfolio

I'll now briefly cover each of the remaining portfolio assets, which can be divided into three categories: producing, development, and early stage. As the name suggests, "producing" assets are operational mines already providing royalty payments to the company. "Development" stage assets are those where production is expected to start in the short to medium term, and "early stage" assets are those where production remains a long way off.

Due to the increased risk the further away a project is from production, the development and early stage assets command a lower valuation than those currently producing - accounted for by adjusting the discount rate used in the fair value calculation of the royalty. This also means that when a development stage asset begins production, the fair value appreciates significantly.

Management looks to strike a balance between acquiring development stage royalties at attractive prices and producing royalties with greater certainty of revenues but potentially lower returns. They've moved away from investing in early stage projects due to the much larger degree of speculation involved, but there are still a few in the portfolio.

Producing

Mantos Blancos: In 2019, Ecora acquired a 1.525% NSR royalty over the Mantos Blancos copper mine in Chile for $50.3m. This royalty relates only to the copper produced by the mine and not any of the by-products.

The mine is owned an operated by Capstone Copper - the same company that owns and runs Santo Domingo - and its expected mine life ends in 2038.

Royalty payments for 2022 totalled $6.0m, with the mine producing 48.8kt of copper during the year. Production guidance for 2023 is between 55kt and 63kt, following a project completed in 2022 to expand the throughput of the mine's refining facilities.

Maracas Menchen: Ecora owns a 2% NSR royalty on all mineral products sold from the Maracas Menchen mine in Brazil, which largely consists of vanadium oxide.

The mine is owned and operated by the TSX-listed Largo Resources Limited (Largo) and has an expected mine life ending in 2041.

In 2022, the mine produced 10.4kt of vanadium oxide, generating $3.6m in revenue for Ecora. Production guidance for 2023 is 11kt to 12kt.

McClean Lake mill: In 2017, Ecora entered into C$43.5m financing and streaming agreement with Denison Mines Inc (Denison). Denison has a 22.5% interest in the McClean Lake mill in Canada, which processes uranium from the Cigar Lake mine. The toll revenue earned by Denison is linked to the throughput of uranium and is unaffected by movements in the uranium price.

The financing component consisted of a 13-year C$40.8m loan, bearing interest at a rate of 10% per annum. The loan also has an added mechanism of principle repayment/interest capitalisation determined by the level of toll revenue. In periods where the revenue exceeds the interest payment, the balance is received by Ecora as a repayment of principle. Conversely, in periods where the revenue is less than the interest payment, the interest will capitalise and be paid out of cash flows in the following period. On maturity, the outstanding loan balance is payable regardless of the cash generated from the toll. In 2022, Ecora received $5m in interest and principle repayments from Denison.

In addition to the loan, Ecora also made a payment of C$2.7m to acquire all future toll receipts after the first 215Mlbs of throughput starting 1 July 2016. This will be dependent on the life of the Cigar Lake mine (~2037), and management estimates the probability of throughput exceeding this figure at 60%. After applying this probability to the estimated future cash flows, the stream is valued at $3.4m.

Labrador Iron Ore Royal Corporation (LIORC): Ecora owns a 1.6% equity stake in LIORC, a Toronto-listed company which holds both a royalty and equity interest in the Iron Ore Company of Canada (IOC) - a producer of high-quality iron ore pellets, used in the production of low-carbon steel. LIORC receives revenue from its 7% gross revenue royalty, along with dividend income from its equity stake. Since LIORC is effectively a pass-through vehicle, Ecora accounts for the holding as a part ownership of the IOC royalty, which has an estimated life ending in 2045.

Ecora's equity stake used to be much higher at ~5.5%, but it sold 2,510,700 shares in Q1 FY21 for C$82.4m to fund the Voisey's Bay acquisition. This proved to be opportune timing as the valuation was boosted by elevated iron ore prices, resulting in a C$19.2m capital gain on sale.

In 2022, Ecora received C$3.10 per share in dividends from LIORC, equating to a total of C$3.2m (US$2.5m) on its shareholding. This is 48% less than the previous year (C$6.00 per share), due to iron ore prices softening in 2022 vs 2021.

EVBC: Ecora has a 2.5% NSR royalty over the EVBC gold, copper and silver mine, located in Northern Spain. The mine is owned and operated by TSC-listed Orvana Minerals Corp (Orvana) and is estimated to be fully depleted in 2026.

In 2022, the royalty earned was $2.8m, but unfortunately Orvana has been struggling to make this payment due to margin pressure, and so Ecora have been in discussions with them to defer the payment of the H2 2022 (and possibly 2023) royalty. It's uncertain how and when these payments will be recovered.

Four Mile: Ecora has a 1% NSR royalty over the Four Mile uranium mine in South Australia. The mine is operated by Quasar Resources Pty Ltd (Quasar), and has an estimated end-of-life in 2029.

This is another asset with complications, as Ecora has been in a legal dispute with Quasar over the level of charges being applied against the royalty. In April 2022, Ecora received a favourable decision from the courts, resulting in a payment of approximately A$6.0m. However, Quasar has subsequently appealed the judgement, and so the payment is being held on the balance sheet as deferred income until the result of the appeal is known (expected to be H2 2023).

Carlota: Finally for the producing royalties we have Carlota, which came as part of the royalty portfolio acquired from Sourth32. Ecora owns a 5.0% NSR royalty over the Carlota copper project in the US.

Revenues from this royalty are minimal, totalling just $0.2m in 2022, and production is expected to cease in late 2024 or 2025.

Development

Piaui: In 2017, Ecora acquired a 1% GRR over the Piaui nickel-cobalt project in Brazil, owned by Brazilian Nickel, for $2.0m. This rate increased to 1.25% after specific milestones were not achieved by 31 Dec 2019.

As part of the acquisition agreement, Ecora has the option to increase the royalty to 4.25% in exchange for the payment of $70.0m, subject to the mine passing certain development milestones. Management has ensured it has the funding available through a credit facility should the option arise.

The opportunity is quite promising, as a 4.25% GRR would translate to $17.5m-$22.5m in revenue per annum at current nickel prices. Construction of the mine is expected to begin either late 2023 or early 2024 (subject to the operator securing the required funding), and the subsequent mine life is estimated to be ~18 years.

Incoa: In 2020, Ecora, in partnership with Orion Mineral Royalty Fund LP (Orion), entered into a financing agreement with Incoa Performance Minerals LLC (Incoa), to fund the construction of a calcium carbonate mine in the Dominican Republic and a processing facility in Mobile, Alabama.

Orion will provide the initial tranche of funding to bring the project into production, at which point Ecora will provide a second tranche of funding - totalling $20m - in return for a ~1.23% gross revenue royalty over the mine and processing facility. This second capital injection will be used by Incoa to bring its product to market.

The 1.23% GRR is expected to generate ~$1.75m-$2.00m per annum in cash flow over the first 10 years, and ~$2.75m-$3.00m per annum thereafter, with the mine expected to be producing for at least 30 years based on current reserves, and possibly 100+ years via a mine life extension project.

Construction of the mine, originally expected to be completed in 2021, has unfortunately been delayed, and current guidance is that production won't begin until at least 2024. The risk to Ecora is low however, due to the provision of funding being conditional on production commencing.

As mentioned earlier, the company owns a number of royalties over early stage projects, some of which show promise. I won't cover them here however, for the sake of conciseness.

Accounting Classifications

As we've seen, the company's portfolio contains a diverse mix of assets with a variety of different characteristics. Consequently, the accounting classifications can get a little complex, so a brief explanation of each will probably prove helpful.

Royalty intangible assets: Simple "vanilla" royalties are economically similar to holding a direct interest in the underlying mineral asset, and as such, are classified as intangible assets carried at cost less accumulated amortisation and impairment. The royalty income is recognised as revenue in the income statement.

The intangibility comes from the fact that the company does not actually own the mineral assets themselves, but rather a percentage of the revenue generated from their sale, and thus depends on the performance of the operator.

Examples include: Mantos Blancos, Maracas Menchen, Four Mile, Santo Domingo, and West Musgrave.

Royalty financial instruments: Where additional protections are added to a royalty arrangement, the asset is recognised as a financial instrument instead of an intangible asset. These protections can take the form of penalties for missing performance milestones, minimum payment terms, interest provisions, or mechanisms for conversion into equity of the operator.

Ecora typically requires these kind of additional protections when the risk of the vanilla royalty is deemed too high, but the management still sees significant opportunity in exposure to the underlying resource.

The asset is recognised at fair value on the balance sheet, and movements in fair value are recognised in the income statement, with the exception of LIORC, where fair value movements are taken through other comprehensive income.

Royalty income is not recognised as revenue in the income statement and instead reduces the fair value of the asset. The only exception to this rule is for dividends received from LIORC, which are included in royalty-related revenue in the income statement.

This treatment of royalty income does somewhat distort the earnings of the company, which is why they separately provide "portfolio contribution" figures.

Examples include: EVBC, McClean Lake (Denison), Piaui, and LIORC.

Investment property: This category applies almost exclusively to Kestrel, where Ecora owns the sub-stratum land - and thus the mineral assets - directly. In practice though, the commercial terms are very similar to a vanilla royalty.

The asset is carried at fair value on the balance sheet and movements in fair value are recognised in the income statement. Royalty income is recognised as revenue in the income statement, just like a vanilla royalty.

Example: Kestrel.

Property, plant and equipment: Metal streams, while being similar in many respects to a royalty, are recognised in PP&E due to the fact the company receives physical delivery of the underlying commodity, and bears the associated inventory risk prior to sale.

They are carried at cost less accumulated depletion - calculated on a systematic basis using units of production - and any impairment provision. Metal stream sales are recognised as revenue in the income statement, along with the accompanying cost of sales.

Example: Voisey's Bay.

Income

Portfolio Contribution and Adjusted Earnings

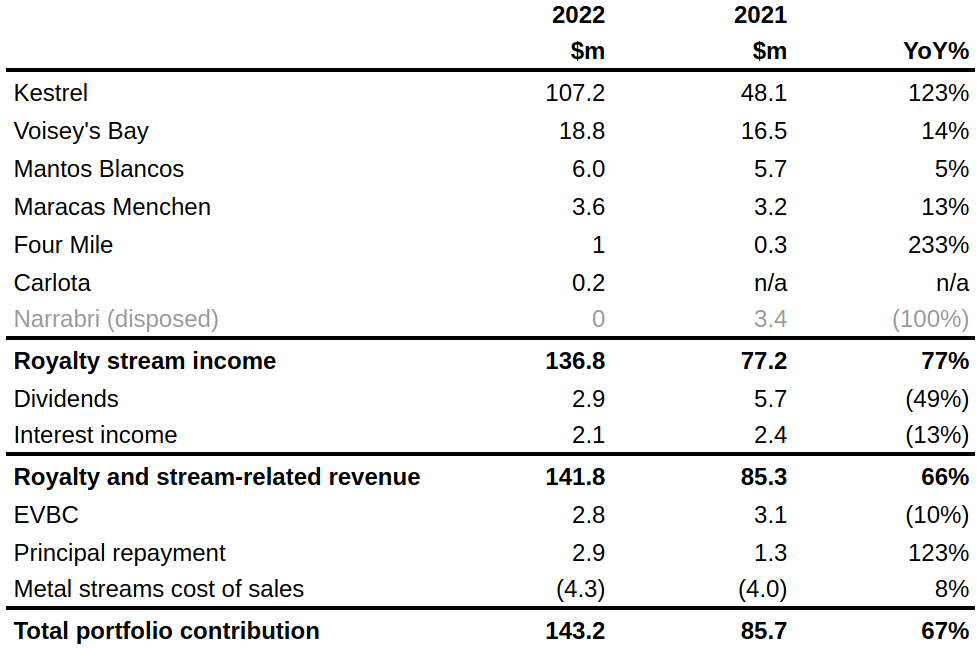

As mentioned in the section above, the accounting treatment of royalties recognised as financial instruments removes their royalty payments from the income statement. To give a more accurate picture, management provides a breakdown of portfolio contributions as shown below.

Kestrel made an outsized contribution due to peak production coinciding with record coal prices, and a favourable change in royalty rates. If coal prices remain close to their current levels, we could expect a couple more years of above average returns, even as the operations begin moving out of the company's royalty area. This expectation is reflected in the fair value calculated at year-end 2022 of $106.7m (YE21: $84.5m).

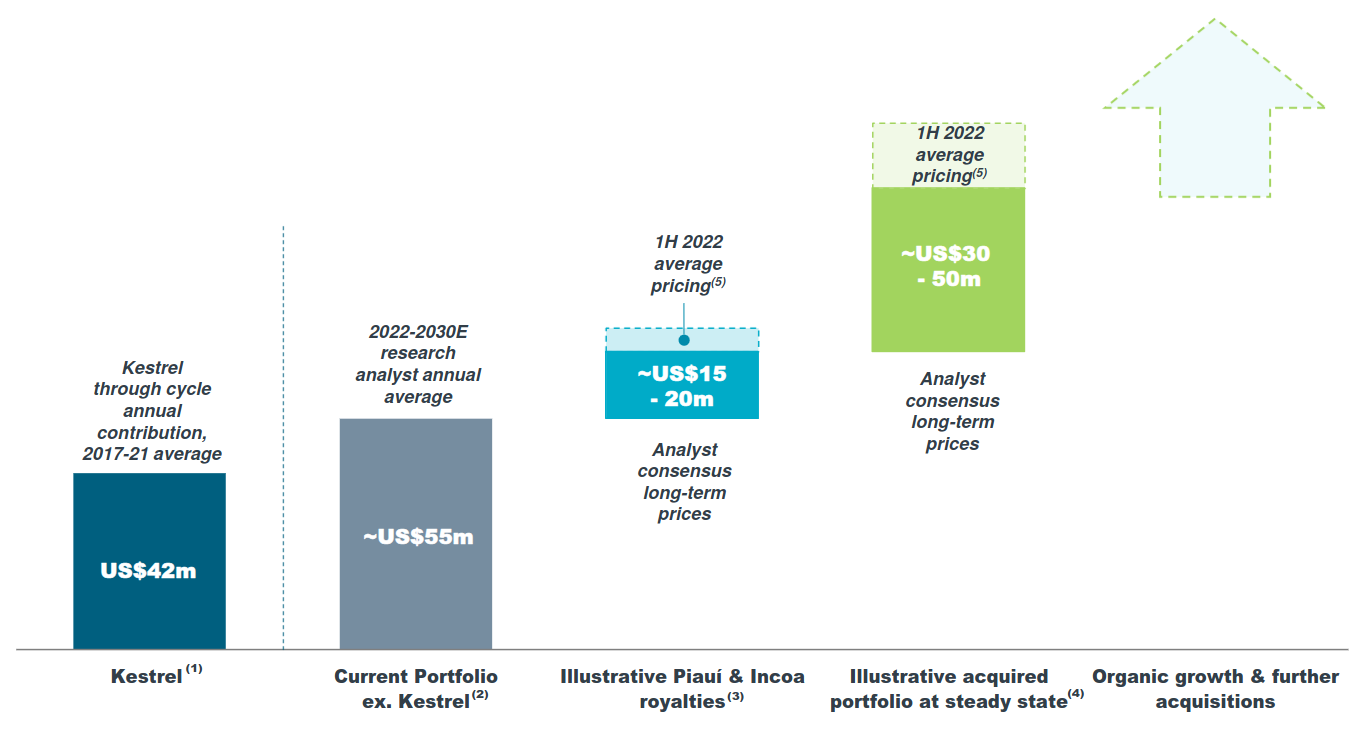

Between 2017 and 2021, Kestrel has made an average portfolio contribution of ~$42m, which Ecora has been working to replace with other assets. Taking Kestrel's contribution away you can see that they're not far off achieving this, bearing in mind that the Voisey's Bay stream has not thus far been running at full capacity.

At the time of the South32 royalty acquisition, management produced a useful graphic that illustrates the effect of past and present acquisitions on the growth trajectory of annual revenues. Using analyst consensus long-term commodity price forecasts, there is a realistic path to consistent annual revenues in excess of $100m. That's without factoring in any upside from structural macroeconomic trends.

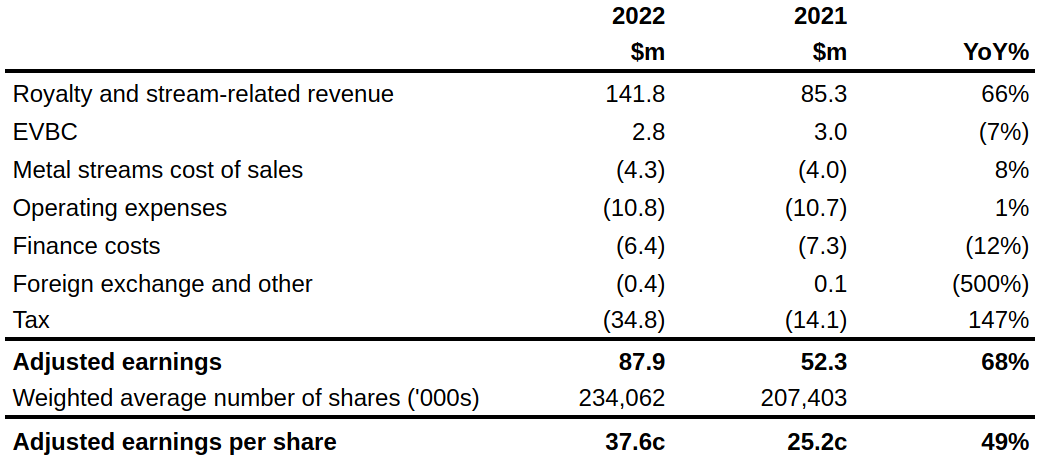

In addition to portfolio contribution, management also uses an adjusted earnings figure to gauge performance, which came in at $87.9m (FY21: $52.3m). This factors in operating expenses, finance and foreign exchange costs, and taxes as shown below.

Often you can cynically say that adjusted earnings figures are used to flatter the results, but in this case, adjusted earnings are actually lower than the reported IFRS profit of $94.6m. This is largely because it removes the revaluation gain from the Kestrel royalty.

Income Statement

Let's move on from the alternative performance measures to look at the IFRS income statement.

The top-line royalty and metal stream-related revenue came in at $141,870k (FY21: $85,295k), from which is subtracted metal stream cost of sales of ($4,265k), amortisation and depletion of royalties and streams of ($9,351k), and operating expenses of ($10,849k), to give an operating profit of $117,405k (FY21: $55,664k).

From this figure is subtracted ($4,083k) for impairment of royalty intangible assets, ($1,373k) for revaluation of royalty financial instruments, ($6,101k) for net finance costs, and ($1,593k) for foreign exchange losses, set against additions of $27,833k for the revaluation of coal royalties, and $3,356k for other income, to arrive at a profit before tax of $135,444k (FY21: $54,639k).

Subtracting current and deferred income tax charges of ($34,470k) and ($6,337k), respectively, gives us the net profit of $94,637k (FY21: $37,476k).

From these profit figures we can calculate the operating and net profit margins as 82.8% and 66.7%, respectively (FY21: 65.3% and 43.9%). The operating costs are largely fixed, so you can see some operational leverage at play here when comparing margins to the prior year.

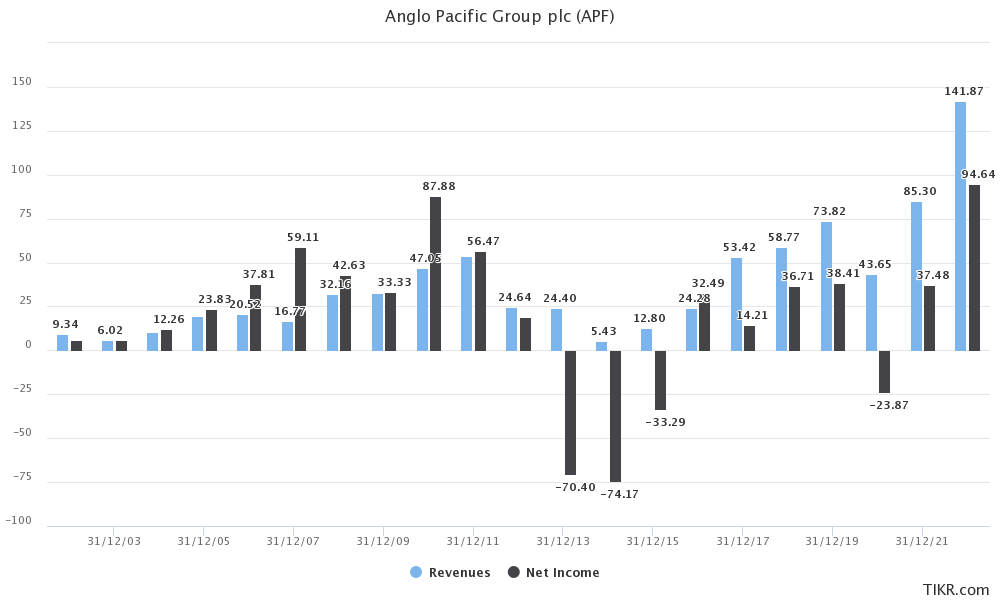

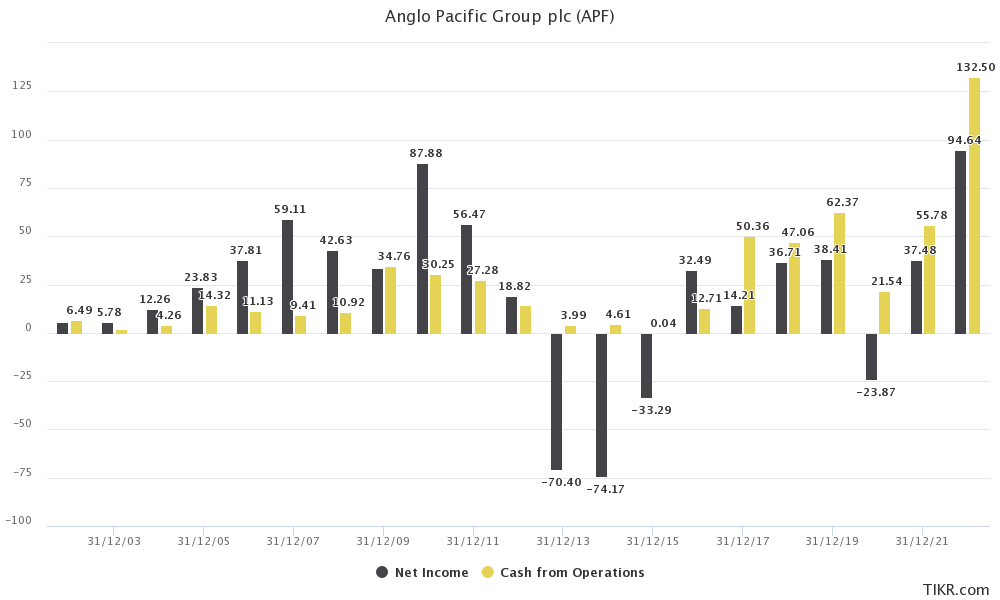

Looking at revenue and net income over time, you can see they have for the most part followed the cycles of the commodity sector. The net income is somewhat distorted by movements in asset valuations and impairments, so doesn't necessary reflect the underlying earning power of the company.

One thing that should be emphasised is the change in asset composition over this 20-year period; the company has moved from a heavy exposure to coal and iron ore, to a mix of metals, including copper, cobalt, and nickel, that will be instrumental to an energy transition. The legacy assets are likely to be fully depleted before any cyclical fall is seen in their values, and Ecora is positioned to ride the new structural growth trend.

This of course relies on the energy transition occurring, which in the balance of probabilities seems likely, even if the pace is somewhat slower than anticipated.

Balance Sheet

At 31 Dec 2022, Ecora had assets totalling $678,936k (2021: $520,459k), which can be divided into non-current and current assets of $651,520k and $27,416k, respectively.

The largest non-current asset components are royalty and exploration intangible assets of $252,549k, metal streams of $164,755k, coal royalties of $106,669k, and royalty financial instruments of $43,880k. As a reminder, the $252,549k of intangible assets is carried at cost, and so will not reflect the true value of royalties purchased during their development stage that have since started production.

Current assets are split between trade and other receivables of $21,566k, and cash and cash equivalents of $5,850k.

On the other side of the ledger, total liabilities came to $175,332k, which can be divided into non-current and current liabilities of $105,756k and $69,576k, respectively.

The non-current liabilities include borrowings of $42,250k, deferred tax of $40,857k, and other payables of $22,649k.

Current liabilities comprised largely trade and other payables of $46,299k, and income tax liabilities of $23,245k. The trade and other payables component is predominantly attributable to deferred consideration for the West Musgrave royalty acquisition, totalling $36,667k. These deferred consideration payments are timed to coincide with the royalty payments from Kestrel, to reduce the amount drawn on the company's revolving credit facility (RCF).

This facility has a provisional credit limit of $150m with a maturity date of 24 Feb 2025. There's also a $50m accordion feature, should it be required to finance future acquisitions, subject to lender consent.

Subtracting liabilities from assets gives us the total equity of $503,604k (2021: $357,103), which can be broken down into share capital of $6,761k, share premium of $169,212k, other reserves of $106,742k, and retained earnings of $220,889k. The share premium and other reserves (mostly merger reserve) are notably large, owing to the use of equity to part-fund recent acquisitions.

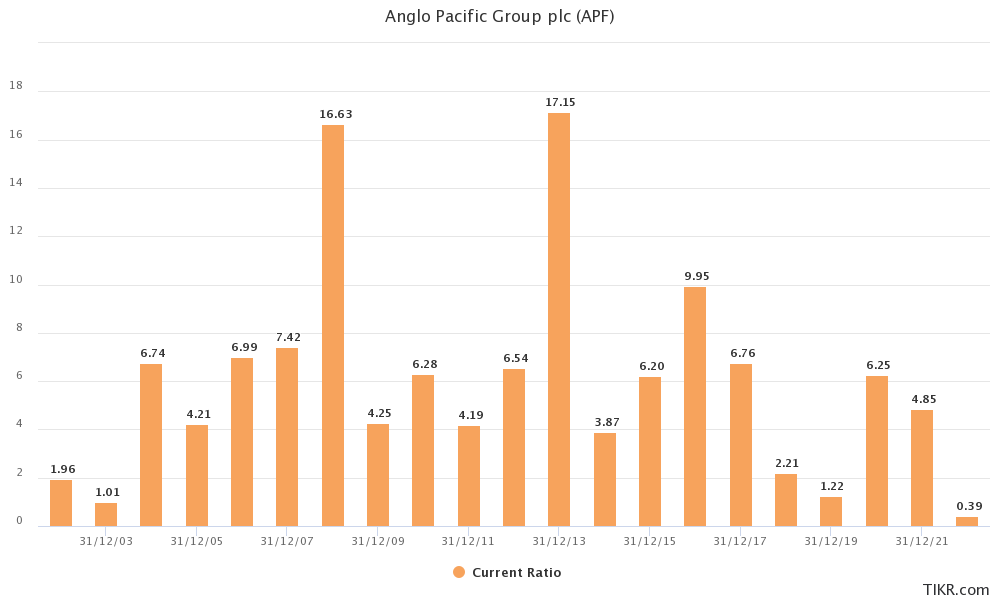

The current ratio of 0.39 looks uncomfortably low on paper, but is skewed by the deferred consideration, which will be transferred to borrowings as the RCF is drawn upon to pay any earnings deficit. Historically, current liabilities have been well covered.

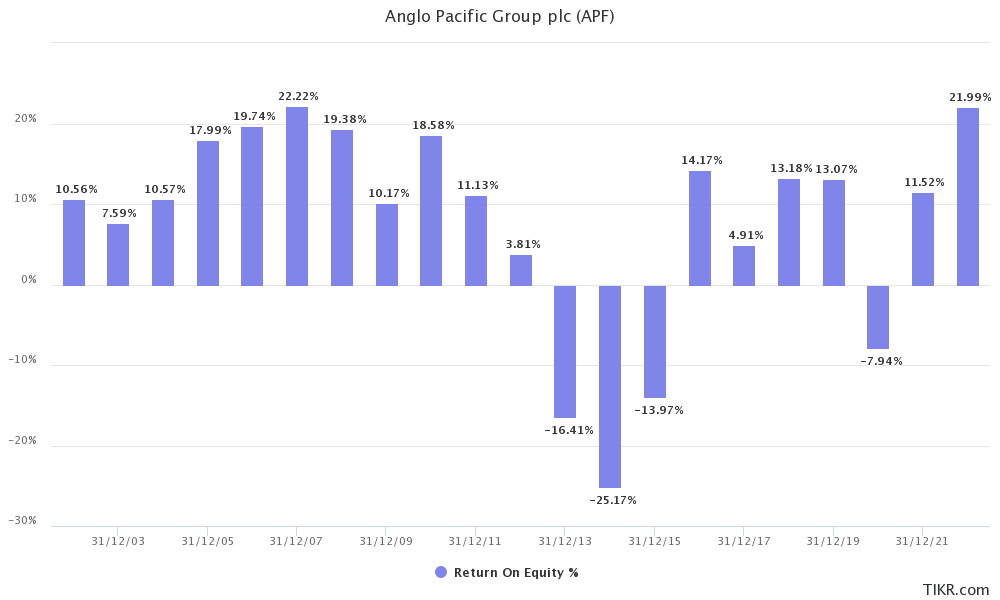

Return on equity (ROE), calculated using net income and average equity, has averaged ~8.0% across the last 21 years. This includes several years of steeply negative losses between 2013 and 2015. Excluding these years, the average has been ~12.4%.

Debt to equity is comfortably low at 8.4%, and were the RCF to be maximally drawn to fund an acquisition, debt to equity would rise to 39.7%. This is still not excessive, but given the current mix of producing/development assets, I think management would seek to pay the debt down as a priority.

Cash Flows

Net cash generated from operating activities came to $132,495k (FY21: $55,780k), not far off the profit before tax figure of $135,444k. This was because the large adjustments made to reverse revaluation gains and subtract income taxes paid, were offset by reversals of amortisation/depreciation and impairments, and working capital movements.

Net cash used in investing activities came to ($54,014k) (FY21: ($136,612k)), primarily attributable to the $59,360k spent on the purchase of royalty and exploration intangibles (South32 royalties).

Net cash used in financing activities came to ($92,737k) (FY21: $76,627k generated), owing to net debt repayments and the dividend.

In aggregate, operating, investing and financing activities resulted in a ($14,256k) decrease in cash and cash equivalents during the year, leaving a balance of $5,850k at year-end (FY21: $21,992k).

Due to operating cash flows excluding the movements in asset prices, they haven't been subject to the same wild swings seen in net income.

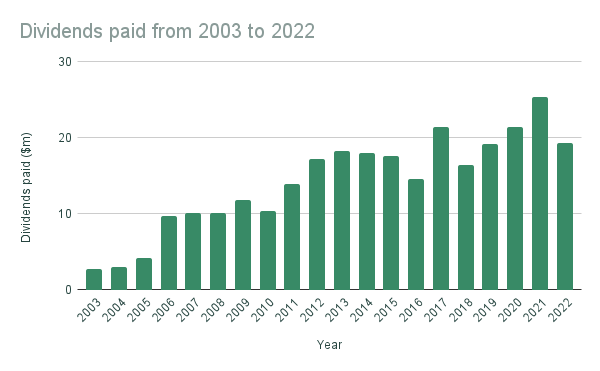

The company has paid an increasing dividend over the years, though there have been years where they've cut it back a little.

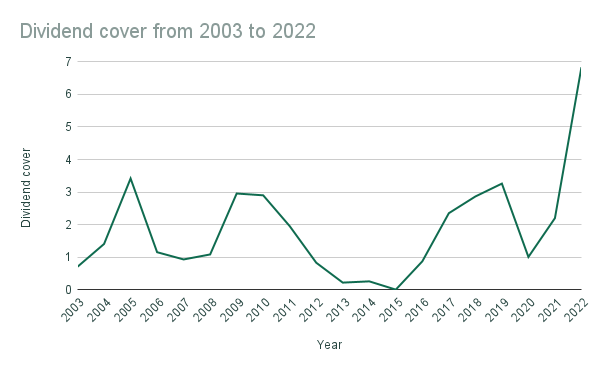

Dividend cover has oscillated somewhat, but the average of the last 20 years has been 1.9x. In the near-term we can expect this cover to be significantly higher than the historical average, as management has elected to keep the dividend at its current level of 8.5c per share.

Management

Marc Bishop Lafleche joined the company in 2014, working in a number of roles, including Chief Investment Officer, before being appointed CEO on 1 Apr 2022. Marc has been instrumental in both the Voisey's Bay and South32 acquisitions, which together total more than $400m and are transformational for the company.

Prior to joining Ecora, Marc worked at Citigroup in both the Metals & Mining Investment Banking and European Leveraged Finance teams, where he was involved in a variety of M&A transactions, in addition to arranging debt and equity financing. He also holds the CFA designation.

Kevin Flynn has served as CFO since joining the company in January 2012, in which time, he has negotiated the group's borrowing facilities, and structured the financing for numerous acquisitions.

Kevin is a Chartered Accountant, and prior to joining Ecora, worked in a number of corporate finance roles in the real estate sector, including senior roles in FTSE 100 and FTSE 250 companies.

Supporting the executive team are an experienced board led by the Chairman, Patrick Meier, who has held the role since May 2017. Patrick is well qualified, having had a 30+ year career in investment banking, specialising in the mining sector. His experience includes a number of senior roles at RBC, including leading the investment banking activities of RBC Capital Markets in Europe and Asia, and before that, RBC's activities in the Metals and Mining sector in Europe, Africa and Asia.

The other board members are: J. E. Rutherford, C. Coignard, R. G. Dacomb, V. Shine, and until recently, R. H. Stan who has just resigned from his post after serving on the board since 2014. All have extensive experience across the finance and mining sectors.

Overall, I think Ecora's management have proven themselves capable capital allocators. In recent years, their efforts have been focused on maintaining, and now growing the earning potential of the asset portfolio. Shareholders will feel the benefits of these efforts in future years, when the company is able to sustainably increase its dividend per share, either through directly increasing the total payout, or through targeted share repurchases.

Executive Compensation

The CEO and CFO receive a base salary of £417k and £325k, respectively. These are in the lower-middle quartile for a company of this size, and are expected to grow above inflation to reach the median level as the Executives develop in their roles.

In addition to base salary, they are eligible to receive an annual bonus of up to 100% of salary, subject to meeting certain performance targets. These are split as follows: 30-40% dependant on growth through the acquisition of new royalties and streams; 25% based on portfolio contribution, adjusted earnings per share, and P/NAV; 15% for meeting certain ESG objectives; and 20-30% for achieving other individually tailored objectives.

Threshold performance earns 25% of the maximum available, with the exception of the growth targets, for which the threshold is set at 0%. The bonus earned above the threshold increases on a straight-line basis up to the maximum of 100%. Any bonus earned above 50% is awarded as shares, subject to a minimum holding period.

For the 9 months from Marc's appointment to the year end, he was awarded a bonus of £225,180, representing 83.4% of the potential award available. For the full 12 months, Kevin was awarded a bonus of £225,150, representing 79% of the potential award available.

The pair are also eligible to receive shares through a long-term incentive program (LTIP), with an annual maximum opportunity of 150% of salary - subject to meeting performance targets.

Performance is assessed using three equal-weighted measures: total shareholder return vs the EMIX Global Mining Index; portfolio contribution; and adjusted earnings per share. The 2023 LTIP requires the following targets to be achieved in 2025: threshold total shareholder return is the index return, and the maximum is index + 7%; threshold portfolio contribution is $54.0m, and the maximum is $77.0m; threshold adjusted earnings per share is 10.5c, and the maximum is 15.5c.

Compared to the levels of portfolio contribution and adjusted earnings per share achieved in 2022, these targets don't seem so stretching. But once you factor in Kestrel moving out of Ecora's royalty area, and the new royalty acquisitions having not yet started production, they appear more challenging.

As with the bonus, threshold performance grants 25% of the maximum award available, increasing on a straight-line basis to 100% for achieving the stretch targets.

Both Executives are required to hold two times their base salary in shares for the duration of their employment and the two-year period immediately following termination.

Valuation

When valuing Ecora's royalty and streaming assets, there is a considerable amount of uncertainty around factors such as commodity prices, production levels, and in the case of development stage projects, the mine actually coming online.

I feel that management has done a good job of incorporating all these factors into the expected future cash flows, and the discount rates used to bring them back to present value - as outlined in the notes to the accounts. On this basis, I think the asset values held on the group's balance sheet are a conservative estimate of the true value of the assets, and not one on which I could improve.

Therefore, I'll make the simple comparison between the company's market capitalisation (~$375m) and the stated book value ($504m), to get a price to book (or price to NAV) ratio of 0.74, representing a pretty healthy discount.

Remember that this book value figure excludes much of the upside that would come from above average commodity prices, or mine-life extensions. There's also the potential for considerable NAV growth (though not seen on the balance sheet) as the development stage assets begin production and start to de-risk.

The exposure to copper, nickel and cobalt, is another source of hidden value - these metals are expected to see very significant price increases should the energy transition occur in the coming years. You could be looking at excess returns, like those seen from Kestrel in 2021 and 2022, for multi-year periods if things really pan out, providing plenty of upside in terms of cash flow and NAV from here.

It isn't much of a stretch to see the portfolio providing revenues greater than $100m in the medium-term, which on the current market cap would translate to a very healthy earnings yield (even after subtracting operating expenses and taxes). And while you wait there's a well covered dividend, currently yielding >5%.