DSW Capital Research Report

This mid-market professional services firm with a capital light business model trades at an undemanding FCF multiple, and has plenty of room for growth.

Company overview and history

DSW Capital (DSW) is a mid-market professional services network listed on the Alternative Investment Market (AIM) of the London Stock Exchange, with a market capitalisation of c.£12.6m at time of writing. They operate under a licencing model, whereby they provide their brand, a suite of back-office services, and cross-referral opportunities to 24 licensee businesses, in return for a licence fee.

Generally this licence fee is based on a percentage of revenue, insulating the company from fluctuations in profit at the licensee level. There are also some profit sharing arrangements in place as we'll discuss later; mostly associated with cases where DSW has provided some funding to the licensee.

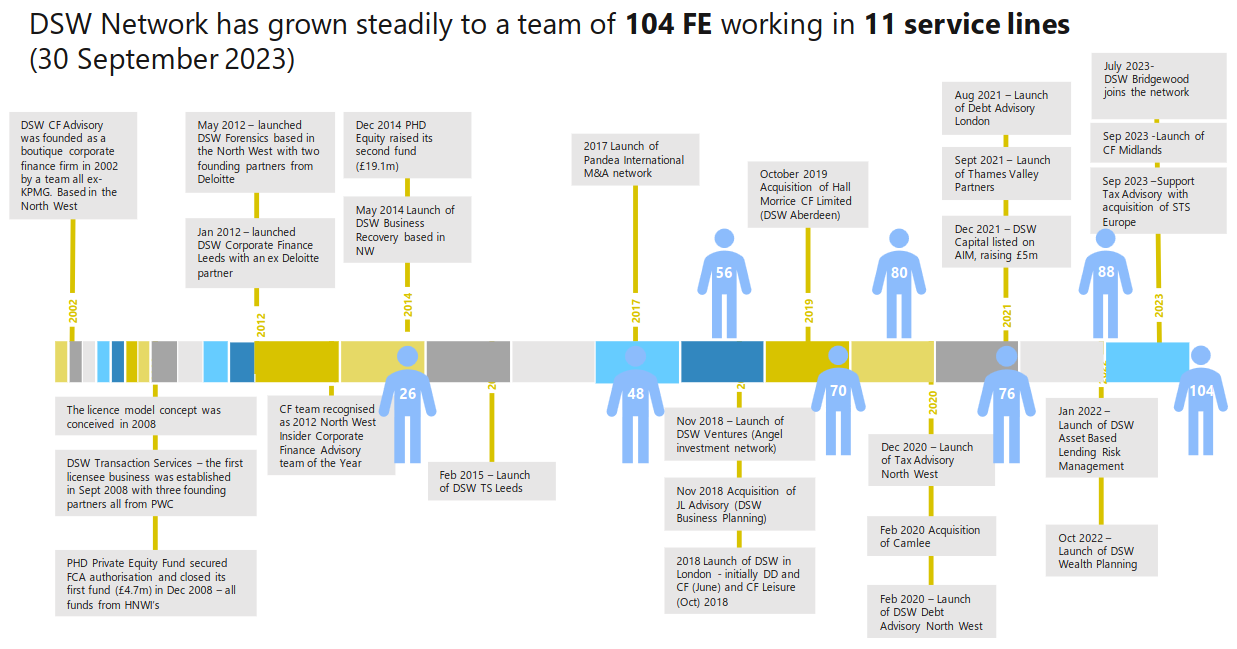

Before going further into the details of the company's business model, it might be instructive to have a look at its history:

- In 2002, James Dow, Jonathon Schofield, and Mark Watts co-founded a corporate finance advisory boutique called Dow Schofield Watts LLP, based in the North West of England. This business still exists today, and remains the single largest member of the DSW network.

- The conception of the licensee network occurred in September 2008, when Dow Schofield Watts Transaction Services LLP was founded and began operating under the Dow Schofield Watts brand.

- In March 2010, DSW Capital Limited was incorporated as a separate entity to hold the trading names Dow Schofield Watts and DSW, which it acquired in March 2011.

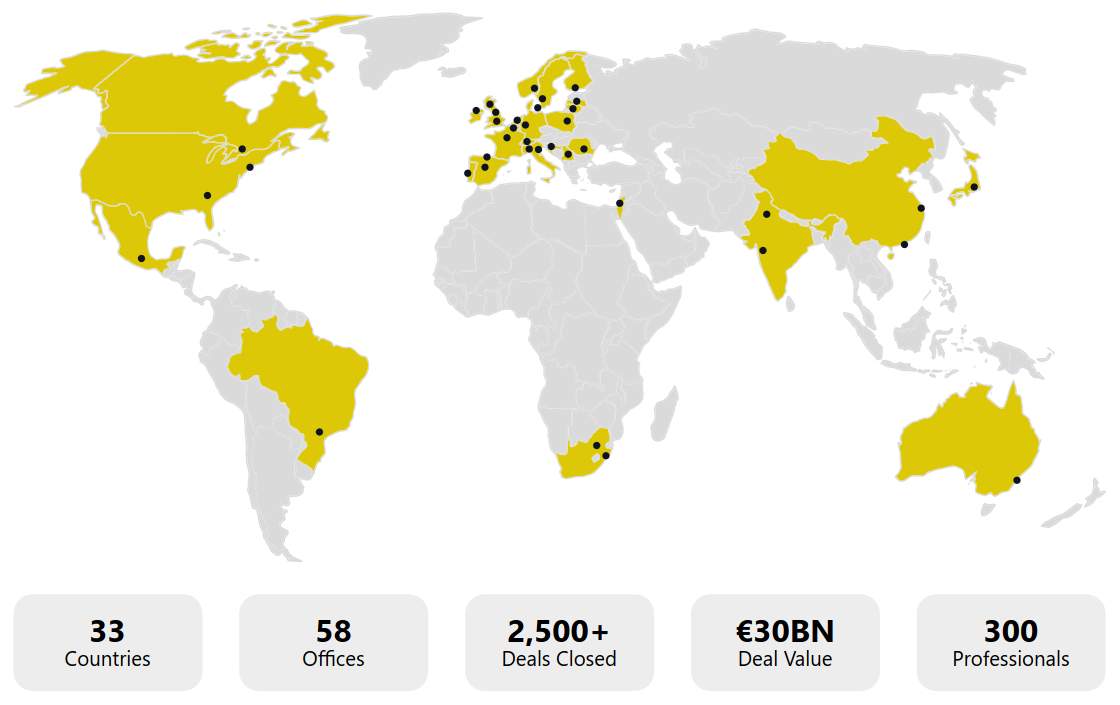

- In 2017, they launched Pandea Global M&A, a network of independent firms focused on the origination and execution of mid-market M&A deals. As of 31 March 2023, this had grown to include 300 professionals, based in 58 offices, across 33 countries.

They describes its benefits as follows:

"It gives DSW enhanced access to overseas buyers, investors and local knowledge while allowing its UK-based clients access to an enhanced pool of acquisition targets and advisors to support overseas expansion"

- On 16 December 2021, the company had its initial public offering (IPO) wherein it issued 5m placing shares at a price of 100 pence per share, raising net proceeds of £4.62m after subtracting issue costs. I'll go into more detail on the IPO later, as there were quite a few moving parts, but for now let's move on to look at the services offered by the network today.

Service lines

As of 27 Nov 2023, DSW provided the following services through its network:

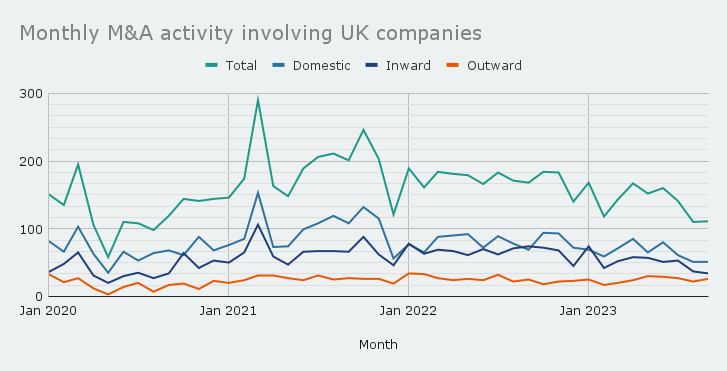

Corporate Finance Advisory and Financial Due Diligence are both related to Merger & Acquisition (M&A) activity, and together make up more than half the fee earners (FEs) in the business. This is also reflected in revenue: in the year ending 31 March 2023 (FY23), 73% of revenue came from M&A related activity. Note: there were 10 fewer fee earners in business recovery during this period as I'll explain in a moment.

The chart below, constructed using ONS data, shows monthly M&A activity involving UK companies. As you can see, activity levels can fluctuate quite wildly and were lower in 2023 than the prior two years. There are signs that the market may have bottomed, with an uptick in activity in the final few months of the year (not shown on graph).

DSW has been making efforts to diversify into counter-cyclical service lines like Business Recovery, including the acquisition of Bridgewood in July 2023, which brought an additional 10 fee earners to the network.

Tax Services is another service line the company is looking to grow as it is naturally complementary to their corporate finance business, creating significant opportunities for cross-referral. Progress towards this end was recently made with the acquisition of STS Europe Ltd, bringing an additional fee earner to DSW Tax Advisory - a licensee business.

The Forensics Services team shown above stated their intention to leave on 31 Dec 2023, so should no longer be part of the network at the time of writing.

The Equity Finance division relates to a private equity business setup by several members of the original DSW team, that has subsequently been incorporated into a conglomerate called PHD Industrial Holdings.

There is an agreement wherein PHD Industrial Holdings pays a fixed licence fee of £144k per annum, alongside a service contract in which central costs are recharged on a per head basis for c.£48k per annum. This agreement lasts until 31 Dec 2024, where upon they will be able to acquire the PHD Industrial Holdings trademark for £1. From this date onwards, I would expect the licence fee to cease but the service contract to continue.

From the information above, and their most recent regulatory filings, I estimate the number of fee earners to at present be around 100, spread across 24 licensee businesses, and 10 offices.

Let's look in some more detail at the licencing agreements between DSW Capital and its licensees.

Licencing agreements

The licencing agreements take various forms, but principally they involve payment of a licence fee in return for use of the DSW brand name. The licence fees range from 10% to 22% of revenue, but the standard rate is 22% for new licensees.

The reason for the range, is the licence fee was lower in the past, so older licensees are locked into a lower rate. There are also cases where a lower licence fee is paid due to a parallel profit sharing arrangement being in place. An example of such a case would be Bridgewood (the insolvency specialist mentioned above) which pays a licence fee based on revenue, and a profit share.

The average licence fee in the 6 month period ending 30 Sep 2023 was 15.6% (including profit share). This was lower than the figure for the prior 12 months (16.6%), due predominantly to lower licensee profits, and therefore profit share, in H1 FY24.

In cases where an existing business is acquired and continues to trade under its original name, DSW will typically acquire the trademark and then licence it back to the acquired company. An example of such an arrangement was the acquisition of The Camlee Group in Feb 2020, wherein DSW issued convertible loan notes in payment for the The Camlee Group's trademarks (more on this later).

There are a couple of schemes in place to incentivise cross-selling and network expansion:

- Licensees receive 10% commission for work referred to other licensees (paid by the recipient). In FY23, 14.2% of network revenue was generated through cross referrals, and it's management's goal to get this up above 22% so that commission earned by licensees covers their licence fee.

- For future start-up licensees, DSW will distribute a portion of the licence fee paid equating to 5% of the licensees' revenue to the other members of the network, bringing the net licence fee received by DSW down to 17%. This is to incentivise both cross-selling and the introduction of new licensees to the network.

Funding

DSW offers a range of funding options to incentivise new licensees to join the network. For start-ups this can take the form of a start-up loan, whereby DSW underwrites the drawings of the partners (at a below market level so they don't sit idle) and other start-up costs for the first 12 months. This is usually provided in the form of an interest free draw-down facility for the first 24 months, thereafter incurring interest of 0.5% per month (c.6.17% per annum).

When acquiring existing businesses, various arrangements may be used, though typically there will be a payment in return for the trademarks where the acquiree continues to trade under its original name (as discussed above). In certain cases, an equity stake may be acquired, and in others financing may take the form of a loan (e.g. Bridgewood was provided loan to fund management buyout).

Finally, to incentivise existing teams to break-out of their current companies and join DSW, a break-out incentive is offered. This equates to £50k per head for a minimum team size of three. The first team to take up the offer in Sep 2023 were a trio based in Leicester who came across from FRP Corporate Finance - a listed peer of DSW with around 92 partners, and 650 employees.

I'll now discuss a couple of acquisitions in more detail.

Recent acquisitions

In Feb 2020, the Company acquired The Camlee Group trademarks with the issuance of convertible loan notes as consideration. The initial value of these notes was £500k, but they carried a clause whereby their value would increase to £700k if DSW became publicly listed within 4 years of their issue. When the IPO occurred in December 2021, the notes were converted into 700k ordinary shares at the issue price of 100p per share.

Simultaneously, the equity of The Camlee Group was acquired for total consideration of £4.5m, consisting of £1.125m in cash and £3.375m in deferred consideration. The deferred consideration is paid out of the future profits of The Camlee Group, and is dependent on the original owners remaining employed for 5 years.

One added complexity is that the payment is being made through a company called Bizarre Holdings Limited, to which DSW Capital has loaned £1.125m to finance the cash consideration. To make things even more complex, DSW Capital borrowed £1.16m from OakNorth Bank plc to finance its loan to Bizarre Holdings - this debt was repaid with the proceeds from the IPO.

Ready for another layer of complexity? DSW Corporate Finance Ltd (a licensee business) has a minority stake in Bizarre Holdings, with the rest held by Camlee's employees in an Employee Benefit Trust. Through this trust, the original owners of The Camlee Group collectively retain 24% ownership.

Put more simply, DSW Capital directly acquired The Camlee Group trademarks through the issuance of convertible loan notes, and helped its licensee (DSW Corporate Finance Ltd) to purchase a minority equity stake via a loan, while the employees retain the majority.

In this case, DSW Capital will receive licence fee payments for use of The Camlee Group trademarks, alongside interest payments from the loan to Bizarre Holdings (repayable by 10 Feb 2040).

Let's move now to a more recent example. In July 2023, DSW Capital provided loans totalling £880k to support the management buyout (MBO) of Bridgewood Financial Solutions Ltd, with £100k of this sum being a working capital loan. Bridgewood has also adopted the DSW brand.

DSW Capital receives interest income on the loan, a reduced rate licence fee, and a share of Bridgewood's profits. Together these are contractually bound to total at least £130k per year for the first three years.

IPO share movements

Here's another complex topic which I'll try my best to break down for you.

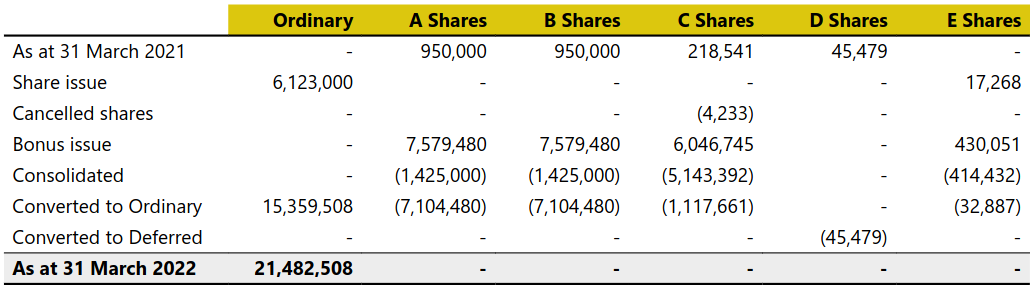

The following table taken from the FY22 annual report shows the share movements during the year ending 31 Mar 2022:

(There were also redeemable preferred shares that were repaid immediately following the IPO for a total cost of £12,500.)

So let's break down the share classes. The A and B shares have been around since 2011, so I won't dwell too much on these other than to say they've been subdivided a few times, and then as you can see, underwent a bonus issue and consolidation to equalise the value of all the share classes before converting them to ordinary shares for the IPO.

The Company implemented a Growth Share Plan for key members of its management team and a number of individuals within the licensee businesses. The C and E shares were issued in respect of this and converted to 1,150,548 ordinary shares prior to the IPO.

The D shares, which were also part of the Growth Share Plan, got converted to deferred shares that were subsequently cancelled at the AGM in September 2022.

Now you might be wondering: Why were 6,123,000 shares issued? I thought there were only 5,000,000 shares in the placing?

So glad you asked. It turns out there are three other things you need to know about:

- 700k shares issued to the Camlee Noteholders to settle the conversion of the convertible loan notes (as discussed above);

- 328k shares issued in relation to "Legacy Awards"; and

- 95k shares issued in an IPO-related contribution to the Group's Performance Share Plan (PSP).

The only one that probably needs some further explanation is the Legacy Awards. These represent 1.53% of the issued share capital following the IPO and are split between the CFO and certain employees of DSW CF Leeds as follows: the CFO is granted options over 1.53% of the equity value over £26m (122p per share), and the individuals at DSW CF Leeds are granted options over 1.53% of the equity value below £26m. When the options vested on 31 March 2023 the share price was well below 122p, so I expect they've all gone to the folks at DSW CF Leeds.

It's worth noting also that the shares issued to satisfy the Legacy Awards and PSP are held in an Employee Benefit Trust (EBT), as with all future PSP awards.

Related party transactions

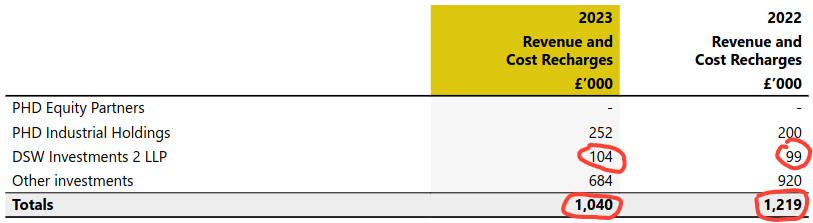

In addition to the agreement with PHD Equity Partners discussed above, there is one other related party transaction of which you should probably be aware. DSW Services (a subsidiary of DSW Capital) has entered into a 10 year lease with DSW Investments 2 LLP (a company connected to James Dow and Jonathon Schofield) for the Daresbury Head Office. This lease started on 1 Oct 2021 with a rent of £102,400 per annum which is subject to review on a yearly basis.

Note that these rent payments have been misstated within the notes to the financial statements. The £104k and £99k figures shown below should have been negative, making the totals £832k and £1,021k for 2023 and 2022, respectively.

It's a simple mistake and I don't think it does any harm to the company, but it does bring into question the credibility of the auditors, as the misstatements exceed their materiality threshold of £65k (2022: £102k).

Competitors

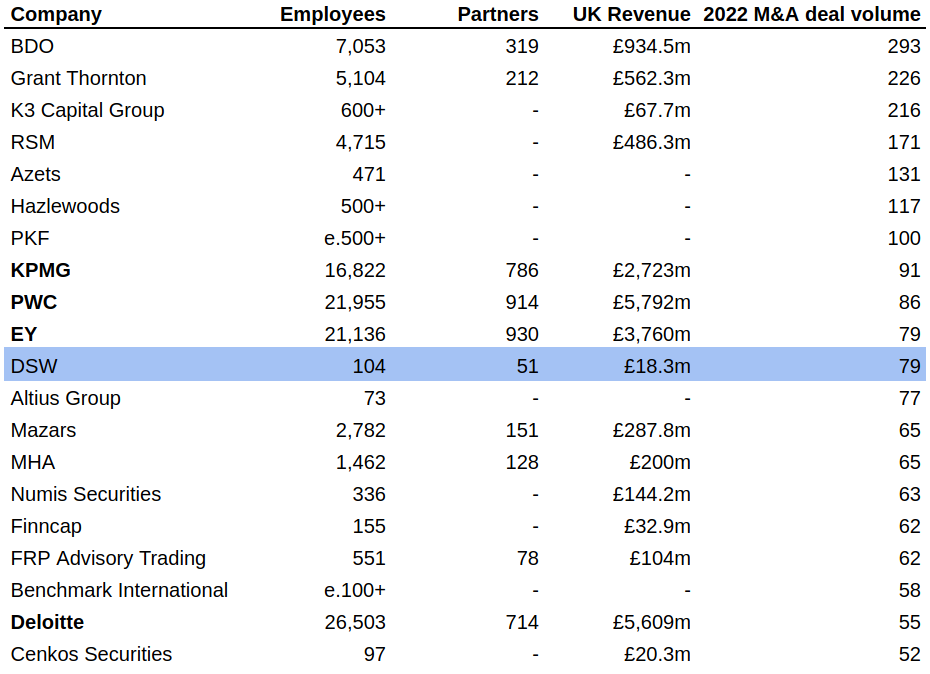

In the table below is a list of the top-20 financial advisory firms by 2022 M&A deal volume, taken from an Experian report. I've added some extra detail on employees, partners, and UK revenue where available.

As you can see, DSW came in 11th place by deal volume, close behind 3 of the Big 4 accounting firms, and ahead of the 4th. Obviously the average deal size - and therefore fee - is likely to be larger for these firms, so deal volume doesn't paint the whole picture.

The businesses listed also vary quite considerably by type: there is a mix of LLPs, LLCs, and PLCs - hence the varying amounts of information. The number of employees shown is for the whole UK business and includes all service lines, not just M&A. The same is true for revenue.

DSW ranks higher in regions where they have a greater presence, such as the North West where they closed 49 deals and ranked 2nd, the Midlands where they closed 19 deals and ranked 8th, and Yorkshire & Humber where they closed 12 deals and ranked 9th.

While the firms shown above operate in the same service lines, they have quite different corporate structures to DSW.

A better comparison is probably Keystone Law - an AIM listed legal firm with a market capitalisation of £166.9m. They operate under the same licensee network model as DSW, with 398 "Principals" (aka partners), and 507 fee earners as of 31 Jan 2023. Their network revenue for the same year was £75.3m, from which they collected £19.6m (26.0%) in licence fees.

DSW's management have made reference to Keystone Law on numerous occasions when discussing such topics as licence fees, revenue per fee earner, and revenue per partner. We'll look at some of these comparisons later on.

Financial statements

Income

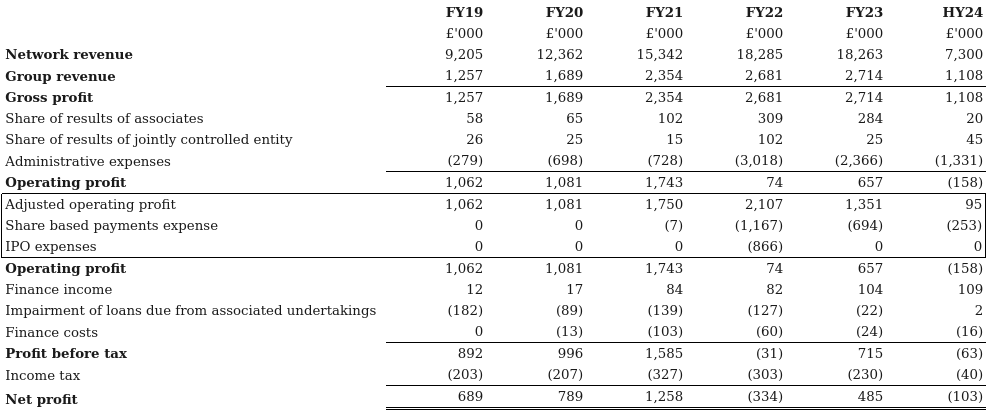

Below is a summary of the Group's income statements for the last 5 full years, and the first half of the current financial year. Note that FY19-FY21 are pre-IPO, so the data comes from the Admission Document.

Network revenue has grown at a compound annual growth rate (CAGR) of 18.68% between FY19 and FY23, while Group revenue has grown at a CAGR of 21.22%. The latter is larger due to the average licence fee having risen over this period.

You'll notice that the profit share income is listed separately from Group revenue. If you add this to the revenue, the CAGR comes out as 22.53%.

As shown in the adjusted operating profit reconciliation, administrative expenses included a lot of non-recurring charges related to the IPO. Not only the clearly labelled "IPO expenses", but also the share based payments expense attributable to the growth share scheme. These shares were all issued during the IPO, but are being expensed over 2 years ending 31 Dec 2023. From FY25 onwards, we should see no further impact on operating profit, and all share based payment expense will be for LTIP awards.

Within FY23 administrative expenses, there were also staff costs of £902k (FY22: £779k) attributable to the Group's 15 central employees (incl. Directors), and a full year's worth of plc costs amounting to c.£500k.

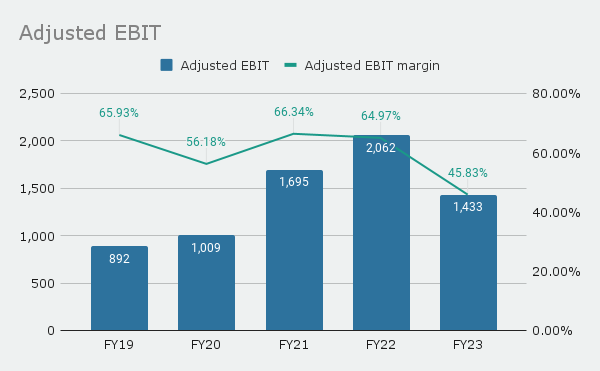

The impact of these plc costs is apparent in the adjusted EBIT margin, which decreased from 64.97% in FY22 to 45.83% in FY23, as shown on the graph below. It's going to take a few years of growth before these additional costs are absorbed.

Finance income relates to interest on loans to licensees, and finance costs relates primarily to interest costs on the office lease, though in earlier years it also included interest on borrowings.

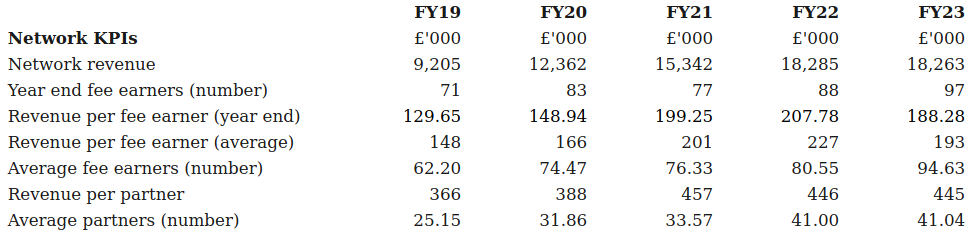

All growth in revenue ultimately comes from growth in the number of partners and fee earners, combined with the amount they are able to individually earn. You can see these KPIs displayed in the table below.

The 5Y average revenue per partner is £420k and the 5Y average revenue per fee earner is £187k.

The IPO proceeds have been used to finance a recruitment drive that has resulted in substantial growth in partner numbers, with the total currently sitting around 50. We should see this reflected in network revenue growth in FY25, and to a lesser extent FY24, as the contribution from increasing partner numbers has been partly offset by a weak M&A market.

I've made the following estimates regarding income and free cash flow for FY24 and FY25:

The Network revenue figure for FY24 is a rough guess based on the prior year and the HY24 results, while the FY25 figure is calculated by multiplying the estimated number of partners (50) by the 5Y average revenue per partner. Adjusted EBIT has been calculated by multiplying the average adjusted EBIT margin of FY19-FY22 by total group income, and then subtracting £500k for plc costs. Free cash flow was calculated by multiplying the 5Y average FCF margin by total group income.

The FY24 adjusted EBIT figure sits within the range of £1.1m to £1.4m for adjusted pre-tax profit provided by management in their trading outlook on 27 Nov 2023.

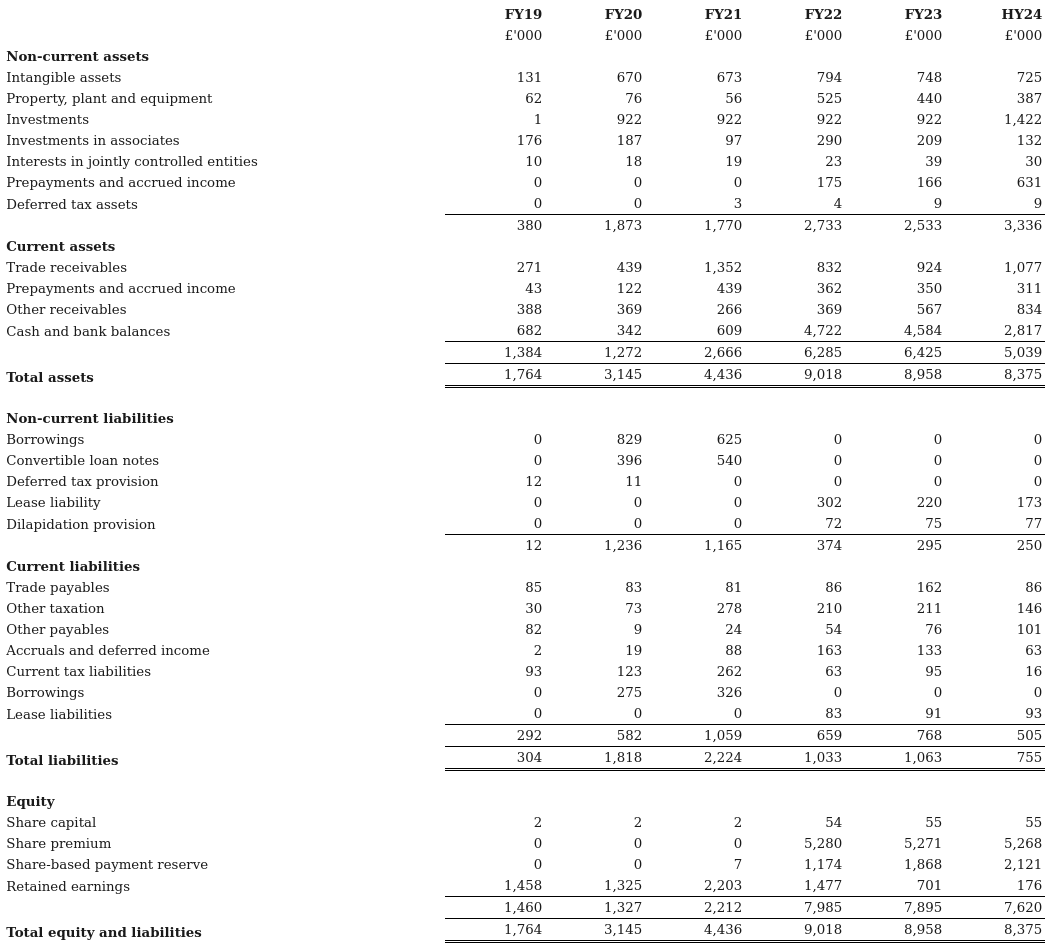

Financial position

Let's move on to the statement of financial position, which I've summarised for FY19 to HY24 below.

Intangible assets relate to trademarks the Company has acquired, such as those from Camlee with a carrying value of £676k on 31 Mar 2023. Investments consists largely of loans made to licensees, carried at amortised cost. The separately disclosed investments in associates and interests in jointly controlled entities are equity stakes in licensees, with their movement included in the cash flow statement as a decrease/(increase) in amounts owed from profit share of associates.

Where a loan has been provided at a below market rate, the fair value component is included in investments, while the rest is recognised as prepayments and accrued income (hence the non-current asset component). You can see there was a big jump in prepayments and accrued income in HY24; this was due to the loan made to Bridgewood in July to finance their management buyout.

The Company has a healthy cash balance, bolstered by the proceeds of the IPO which they also used to clear their borrowings. Once this cash has been fully deployed, management have said they would consider taking on a modest amount of debt in order to finance further acquisitions, so we might see a little leverage again in the future.

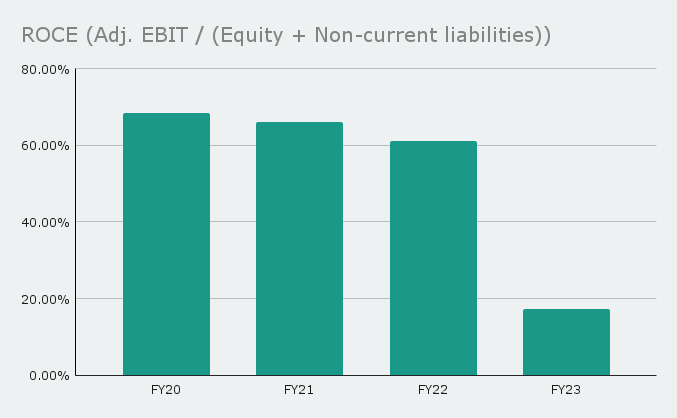

The capital light nature of the licence model is visible in the high Return on Capital Employed (ROCE) shown in the following graph.

FY23 is obviously a lot lower due to the proceeds of the IPO in the denominator. Once these have been deployed, we should expect to see ROCE return towards its prior level. There will however be an impact on the numerator from ongoing plc costs, just as we saw with margins.

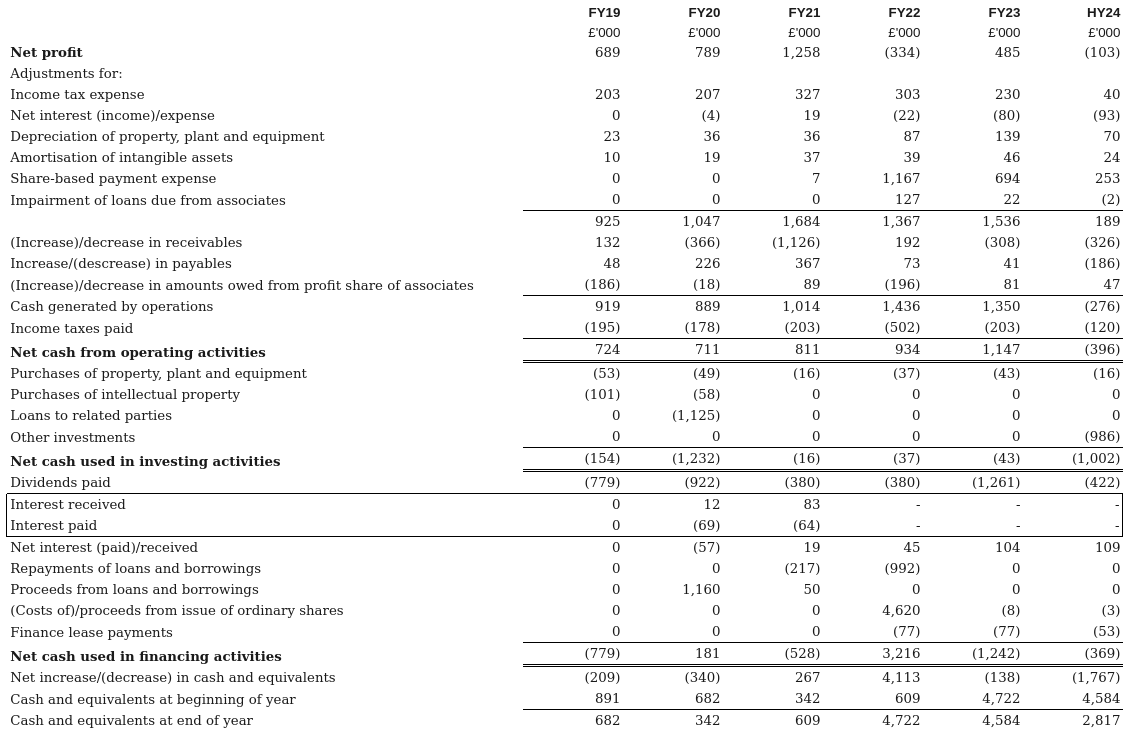

Cash flows

A couple of points of interest: you can see the loan made to Bizarre Holdings in FY20 for the Camlee acquisition under "loans to related parties", along with the corresponding bank loan used to finance it under "proceeds from loans and borrowings". Similarly in HY24, there is the loan made to Bridgewood to finance the management buyout, recorded under "other investments".

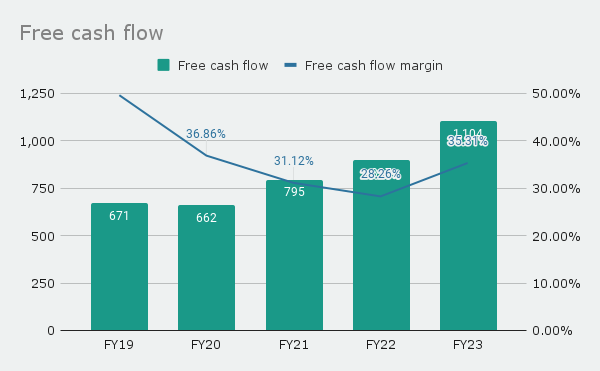

Free cash flow has grown fairly steadily with a CAGR of 13.26% since FY19. The current level is sufficient to cover the total dividend of 3.76p, equating to around £793k.

The policy with regards to dividends is to pay 70% of adjusted after tax profits (which is fairly analogous to FCF), but they're also intending for it to be progressive - meaning they will hold it at its current level even if profit temporarily falls. On this basis they're expecting to pay a total of 3.76p per share again in FY24, despite somewhat lower forecast profits.

Management

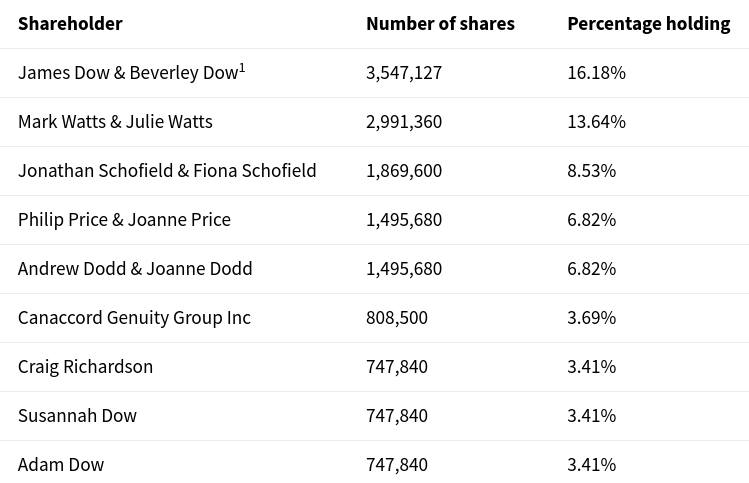

James Dow has served as Chief Executive Officer since the business was established, having been one of the original founders. He also retains a healthy 16.18% ownership stake in the company, making him the largest shareholder.

Nicole Burstow was appointed Chief Financial Officer in 2019, having previously been a Director at Deloitte in Manchester where she lead the audit of various large and complex international businesses. In October last year she was promoted to Deputy CEO, but on 17th Jan we heard that she tendered her resignation, having been offered a position elsewhere. She'll remain in role until the end of June, while the Company finds a replacement.

The rest of the Board consists of three Non-Executive Directors: Heather Lauder (Chair), Jill Jones, and Jon Schofield. All have extensive accounting and finance experience, and Heather Lauder and Jill Jones are both independent of the Company.

Executive compensation

James Dow and Nicole Burstow were paid base salaries of £214k and £118k respectively in FY23. In addition to this, the Group runs a Performance Share Plan (PSP) under which shares equal in value to a maximum of 200% of base salary are awarded annually. These vest after three years, with a further two year holding period before they can be sold.

We don't have the specific details of the performance conditions of each award, other than the use of Total Shareholder Return targets set with reference to an applicable comparator group.

There's also an overall limit in place to prevent dilution of more than 10% over a 10-year period:

The PSP may operate over newly issued Shares, Shares held in treasury or Shares purchased in the market. In any ten-calendar year period, the Company may not issue (or grant rights to issue) more than 10 per cent. of the issued ordinary share capital of the Company under the PSP and any other executive discretionary share plan adopted by the Company. In any ten-calendar year period, the Company may not issue (or grant rights to issue) more than 10 per cent. of the issued ordinary share capital of the Company under any employees’ share plan adopted by the Company.

Insider ownership

The Company has a very healthy amount of insider ownership, with 17,431,133 shares, representing 79.5% of the issued share capital on 29 Nov 2023, not in public hands.

The ownership is also not overly concentrated, which is generally a good thing.

Investment outlook

The current share price of £0.585 represents a pretty attractive entry point, with the shares having come down more than 50% from their peak.

In terms of valuation, the Company is currently trading at around 11.4x FY23 FCF with a dividend yield of 6.4%. If they're able to match their historic FCF growth rate, this multiple could come down to 7.9x by FY26, and from my fairly conservative estimate based on the current number of partners, you would be looking at around 10x by FY25. These aren't particularly demanding multiples, and offer you a fair margin of safety if growth stalls.

There's plenty of upside here as well. The proceeds of the IPO have allowed them to accelerate partner acquisitions, and they should be able to keep going at the same rate for another year or so. After this I'd expect partner acquisition to be more gradual, but we should see some steady organic growth in fee earners as the licensees themselves grow.

It's hard to put a timeline on it, but I don't see any reason why they couldn't grow to have 500+ fee earners like some of their competitors in the long-term. James Dow certainly seems ambitious enough to make it happen, though I suppose it will depend upon how much energy he puts into DSW Capital versus his other ventures.