Aviva's acquisition of Direct Line Group

If realised, the considerable cost and capital synergies from this transaction could contribute towards an IRR in excess of 20%.

Introduction

On 19 Nov 2024, Aviva submitted a non-binding proposal to the Board of Direct Line Insurance Group plc (DLG), regarding a possible offer to acquire the company. This offer, valuing DLG at 250 pence per share, was rejected by the Board, who stated it was "highly opportunistic and substantially undervalued the company".

On the 6 Dec 2024, a joint statement was released by Aviva and DLG recommending DLG shareholders accept a revised 275 pence per share offer, divided as follows: 129.7 pence in cash; 0.2867 new Aviva shares (based on a closing price of 489.3 pence on 27 Nov 2024); and up to 5 pence in dividends paid prior to completion.

This values the entire diluted share capital of DLG at approximately £3.7bn, representing a premium of approximately 73.3% to the closing price of 158.7 pence per DLG share on 27 Nov 2024, and 49.7% to the six month volume weighted average price of 183.7 pence per DLG share to 27 Nov 2024.

As a result of the share component of the offer, DLG shareholders will upon completion own approximately 12.5% of the issued share capital of Aviva.

The acquisition is expected to complete by mid-2025, with a long stop date of 11:59pm on 31 Dec 2025. It is still subject to a vote by DLG shareholders, and is likely to receive further regulatory scrutiny before closing, with Aviva required to pay a £60m break fee should it fail to complete.

So what is Aviva getting from this acquisition? Let's take a look.

DLG overview

DLG is a FTSE 250 listed insurance company operating predominantly in UK personal lines, where it has a c.10% market share by gross written premiums. It owns a stable of well known brands, including: Direct Line, Churchill, Darwin, Privilege, and By Miles, that offer motor and home insurance; and Green Flag that offers vehicle breakdown cover (rescue).

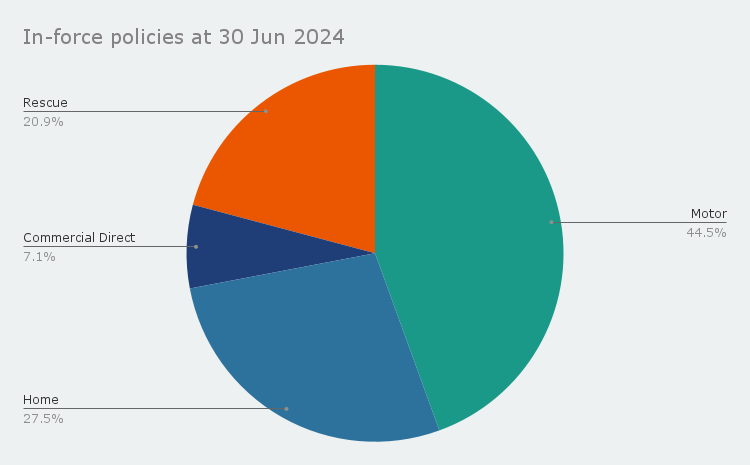

At 30 Jun 2024, the company had around 9.0m in-force policies (including 860k attributable to partnerships within its motor insurance segment), divided between the core segments of motor, home, commercial direct, and rescue, as shown in the pie chart below.

Motor represents the largest segment, with 44.5% of total in-force policies at 30 Jun 2024, compared with 27.5% for home, 20.9% for rescue, and 7.1% for commercial direct.

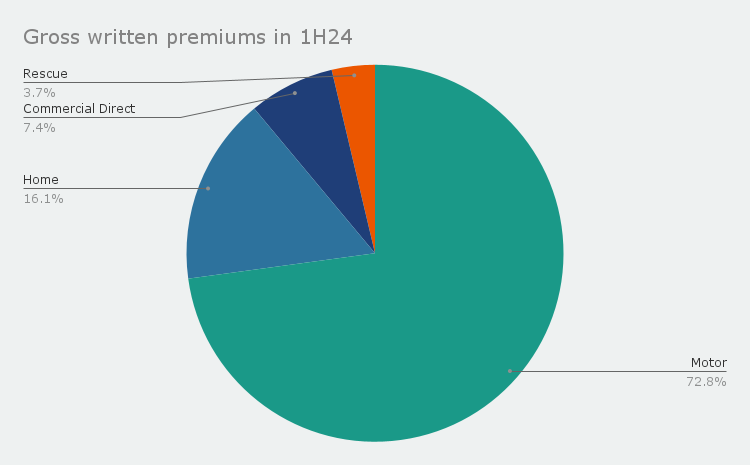

When looking at gross written premiums, motor becomes even more dominant with 72.8% of the total in 1H24, while rescue sees its share fall to just 3.7%, and home and commercial direct contribute 16.1% and 7.4%, respectively.

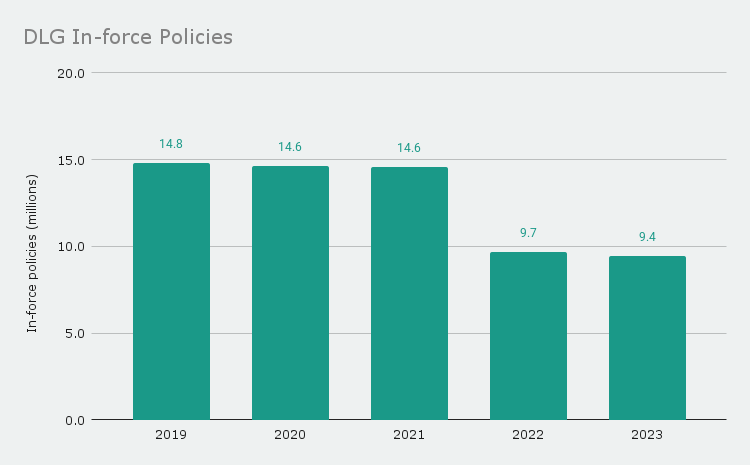

The following graph shows total in-force policies from 2019 to 2023, with a notable drop in 2022 resulting from the decision to expire partnerships with NatWest Group and Nationwide Building Society (involving rescue and travel insurance) due to insufficient margins.

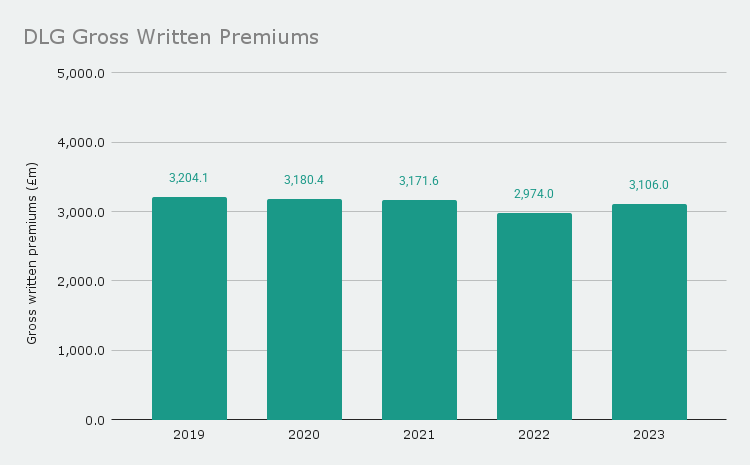

The substantially less pronounced fall in gross written premiums shown in the next graph, from £3,171.6m in 2021 to £2,974.0m in 2022, illustrates the much smaller contribution per policy from these partnerships.

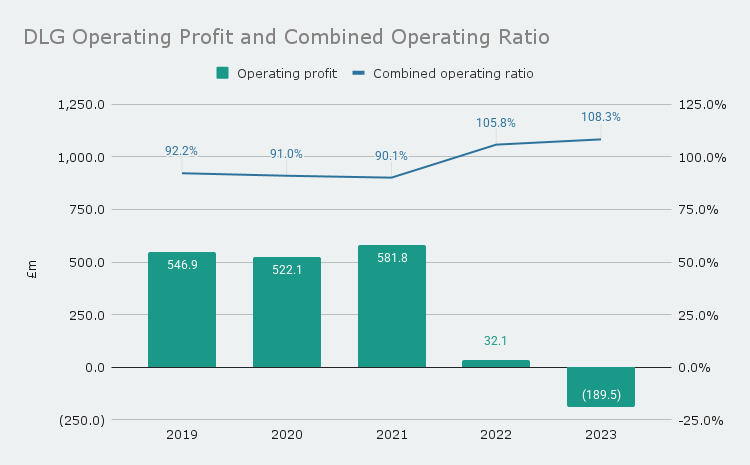

Moving further down the income statement, DLG has historically been a very stable business, with operating profits consistently above £500m, and a combined operating ratio (COR) in the low 90s. This changed in 2022 and 2023 however, when the company failed to sufficiently increase its policy rates to compensate for a period of rapid and sustained claims inflation, resulting in its COR rising from 90.1% in 2021 to 108.3% in 2023, and its operations swinging from a profit of £581.8m to a loss of £189.5m.

At the end of 2022, DLG's solvency capital ratio had fallen to 147% and the Board took the decision to cancel the final dividend for FY22 to conserve capital. In Sep 2023, the company also sold its brokered commercial business to Royal & Sun Alliance Insurance Limited (RSA), raising £520m, and recognising a profit of £443.9m, which was used to further shore up the balance sheet.

As you can imagine, shareholders were not particularly happy with these events and DLG's share price saw a consequent fall of around 50% from the end of 2021 to mid-2023. Heads also rolled, with Penny James (the CEO) stepping down at the end of Jan 2023 - replaced in the interim by Jon Greenwood.

In Mar 2024, Adam Winslow left his role as head of UK & Ireland General Insurance at Aviva to become CEO of DLG on a permanent basis.

Given the subsequent takeover bid, I do wonder whether he was sent in as a Trojan Horse to prepare the ground for a takeover, or if Aviva's CEO (Amanda Blanc) is demonstrating a previously unseen capacity for ruthlessness, and taking her revenge for the defection? I guess we'll have to see how Mr Winslow fares in the aftermath.

Jokes aside, DLG has seen considerable progress during Adam Winslow's tenure, generating an operating profit of £63.7m, and achieving a COR of 98.2% in the first half of FY24. His team are targeting a £100m cost reduction from a total addressable cost base of £652m by the end of 2025, and believe they can deliver a net insurance margin of 13% (COR of 87%) in 2026.

The company's capital is also on a much more secure footing, having built a surplus of £1.12bn above its solvency capital requirement of £1.14bn, giving it a solvency capital ratio of 198%. This has allowed the Board to resume dividends, though using a variable payment tied to profits (60%), instead of the progressive dividend policy previously employed.

So how does DLG compare to Aviva's UK General Insurance business? Let's have a look at the companies side by side.

Aviva side by side

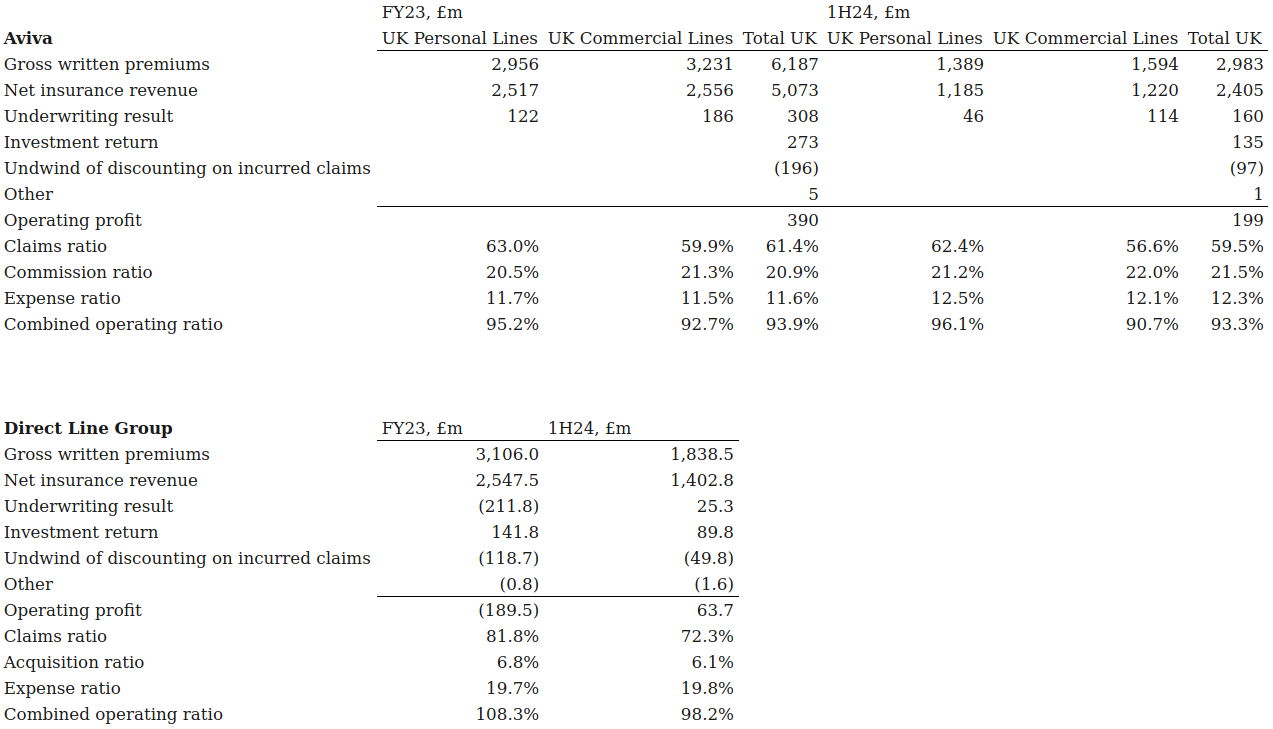

You can see straight away that DLG is a pretty similar size to Aviva's UK personal lines business, with gross written premiums in FY23 of £3,106m and £2,956m respectively. Stripping out commercial lines and partnerships brings down DLG's premiums to around £2.4bn, so a little smaller on a like-for-like basis.

What's also clear, is Aviva did a much better job of pricing its policies through the inflation experienced in FY23, achieving an underwriting profit of £122m and COR of 95.2% from personal lines, while DLG recorded an underwriting loss of £211.8m and COR of 108.3%. The contrast is also stark when you look specifically at the claims ratio, where Aviva recorded a value of 63.0% for its UK personal lines, compared with DLG's 81.8%. The gap had closed quite a bit in 1H24, but was still almost 10pts at 62.4% and 72.3%, for Aviva and DLG respectively.

As a point of interest, you'll also note that Aviva's UK commercial lines business performed significantly better in FY23, with an underwriting profit of £186m on £3,231m of gross written premiums, and a COR of 92.7%, which improved still further to 90.7% in 1H24. Looking at the historical precedent, we should expect to see the personal lines business of both Aviva and DLG trend back down to this level over the coming years.

Let's move now to the deal itself, including an estimated IRR, and the possible synergies that can be realised by adding DLG to the combined group.

The deal

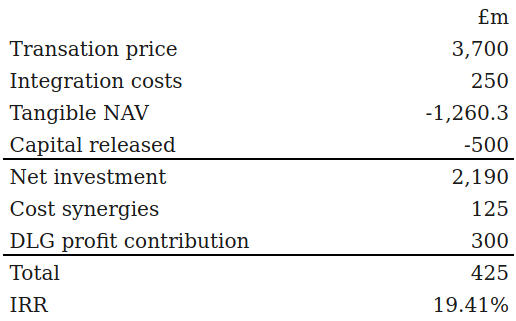

Aviva has produced a Quantified Financial Benefits Statement (QFBS), in which annual run-rate pre-tax cost synergies of at least £125m have been identified, with the expectation that they will be realised within 3 years of completion.

Approximately 50% of this figure comes from a reduction in staff and other costs related to head office and senior management functions; 30% from staff costs and efficiency gains in the combined insurance operations; and 20% from the unification of middle-office IT platforms and support teams.

The integration process is anticipated to require £250m in one-off integration costs, of which 75% is expected to be incurred in the first two years post-completion.

There are also very significant capital synergies from the addition of DLG to the group. These come principally in the form of a two-fold diversification benefit: DLG's SCR will decrease when added to Aviva's much broader UK GI business, with its large commercial lines component; and Aviva's group diversification benefit will increase.

For context, Aviva's group diversification benefit amounted to £2.3bn at 30 Jun 2024, and brought the total SCR down to £7.8bn. At the same date, the UK & Ireland GI business had an SCR of £1.5bn, accounting for around 15% of the total SCR before applying the group diversification benefit.

External estimates suggest the combined diversification benefits could free up £500m-£600m of capital, and I'm inclined to agree with this range given the movements we've seen in both the UK & Ireland GI SCR, and group diversification benefit over the last few years.

Aviva's UK GI business achieved a return on equity (ROE) of 22% in 1H24, and the expected reduction in required capital should serve to further improve this figure post-completion.

While we're discussing capital, Aviva has said that the group's shareholder cover ratio will be at the top end of its 160-180% working range immediately after the acquisition, and before any capital synergies are realised. Since the cash component of the total consideration is being funded using internal resources, the group's resultant debt leverage ratio will only marginally increase to c.31-32% post-completion.

With regard to capital returns, there is expected to be a pause in buybacks during 2025, followed by their resumption at a higher level from 2026, as DLG begins contributing cash flows to the group. Dividends will not be paused, and there's going to be a mid-single digit uplift in dividend per share post-completion, followed by mid-single digit growth in cash cost from this rebased level, as previously forecast.

Needless to say, there are plenty of less quantifiable opportunities for value creation from the acquisition, such as cross-selling between products as the DLG brands are brought into the MyAviva platform, or increased negotiating power as a result of the combined group controlling 20%+ of the UK personal lines market.

Focusing on just the immediately quantifiable value drivers, what does the internal rate of return (IRR) look like?

Adding the integration costs to the transaction price, and then subtracting the tangible net asset value and capital released, which we'll say is £500m, gives us a net investment of £2,190m. In return, we expect to get at least £125m in ongoing cost synergies, and we'll very conservatively say £300m in profit contribution from DLG. This gives us an IRR of 19.41%.

I think it's therefore fair to say that if Aviva is able to realise the opportunities outlined and bring DLG back to its historical level of profitability, this represents a very attractive acquisition for the company.