Company Updates - FSTA, TMI, TBLD

Trading updates from Fuller's and TMI; and tinyBuild vote passes.

Fuller, Smith & Turner

Fuller's has released a trading update for the 42 weeks to 20 Jan 2024. Overall, the business has delivered 11.5% sales growth versus the year before, and trading during the Christmas and New Year period was particularly strong with sales up 21.6%.

Taylor Maritime Investments

We also got a trading update from TMI covering the quarter ending 31 Dec 2023. Here are some highlights:

- NAV per share has increased to $1.36 from $1.31 the prior quarter due to a recovery in vessel values.

- The average charter income for the quarter rose c.15% to $11,977 per day, and the average time charter equivalent (TCE) rate at the quarter end was $11,996 per day.

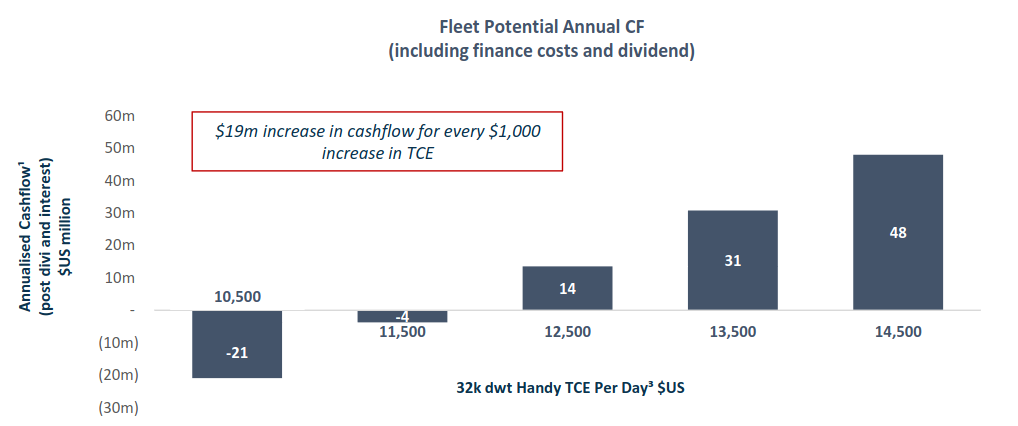

- At this level the fleet is breaking even, and every $1,000 increase in TCE from here will increase cash flow by $19m on an annualised basis. (Note: the break-even includes finance costs and the dividend.)

- TMI's debt-to-gross assets decreased to 24.9% at quarter end from 26.9%, after the repayment of a further $11.4m of debt. On a look-through basis (including Grindrod's debt), debt-to-gross assets was 35%.

- Debt repayment remains a priority, and management is looking to bring down the look-through debt-to-gross assets to 25-30% through additional asset sales. This, along with the realisation of planned operational synergies, should reduce the break-even TCE, and increase the net cash flows the company is able to generate.

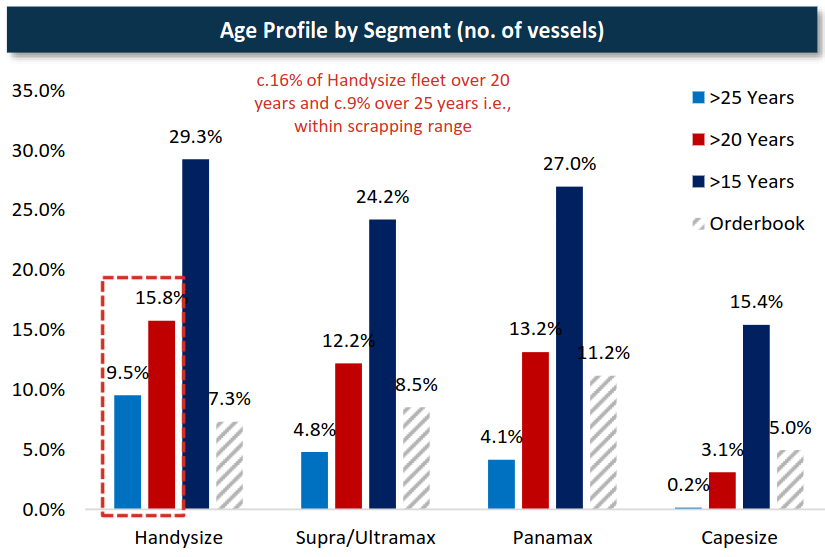

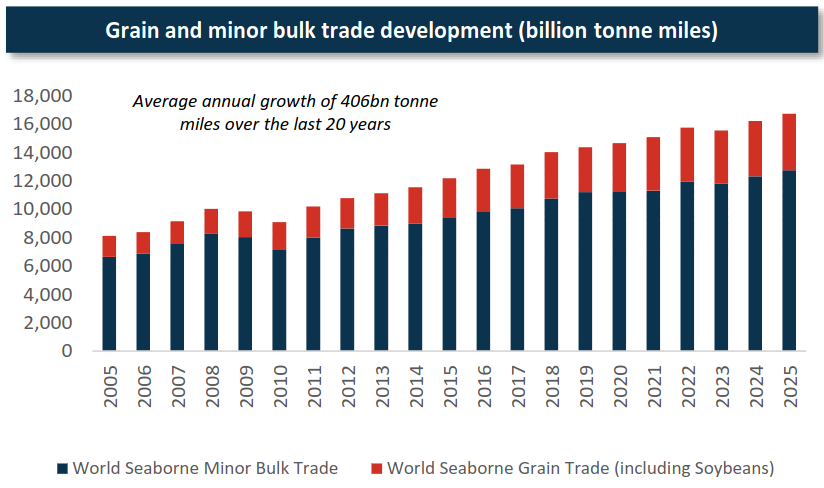

- As highlighted before, the portion of the global Handysize fleet nearing retirement age significantly exceeds the orderbook for new vessels, creating a structural supply deficit, while minor bulk demand continues to increase each year. This presents a significant opportunity over the next few years that TMI is positioned to capture.

- Principals of the original Taylor Maritime group (making up most of the Executive team) acquired a total of 3,910,450 shares in the market during the quarter, bringing their total ownership to c.8% (26,493,914 shares).

tinyBuild

Finally, we got the results of tinyBuild's Special Meeting on Friday: all resolutions passed, and so the net proceeds of c.$11.4m will be released.

In the end, 4,844,179 shares were subscribed by investors through the Open Offer, raising gross proceeds of $0.31m. This exceeded the 4,000,000 shares subscribed by institutional investors in the Placing (excluding the Private Placement given to Atari).

I for one am glad to have this whole sorry saga in the rear-view mirror, so we can move on to the next chapter for the company - which will hopefully be a positive one.